Buy Verified Trustee Plus Account

I couldn’t find specific information about a “Trustee Plus Account” in the context of financial services or platforms. It’s possible that the term “Trustee Plus Account” may refer to a particular type of account offered by a financial institution, investment firm, or service provider, but without further context, it’s challenging to provide detailed information.

In general, a “trustee account” typically refers to an account managed by a trustee on behalf of a beneficiary or beneficiaries. Trustee accounts are commonly used in various financial and legal arrangements, such as trusts, estates, and retirement plans, where a designated trustee is responsible for administering and managing the assets held in the account for the benefit of the beneficiaries.

If you have additional context or details about the “Trustee Plus Account” you’re referring to, please provide more information so that I can offer a more specific response. Otherwise, if it’s a new or specific financial product or service, I recommend reaching out to the provider directly or conducting further research to gather more information about its features, benefits, and terms.

How To Create Verified Trustee Plus Account

Specific information about a “Trustee Plus Account” and how to create one, as it seems to be a term that lacks context or specificity within the financial industry. However, if “Trustee Plus Account” refers to a particular type of account offered by a financial institution, investment firm, or service provider, you would typically follow their specific process for account creation.

Here are general steps you might take to create a trustee account or a similar account:

- Choose a Provider: Research financial institutions, investment firms, or service providers that offer trustee accounts or similar services. Look for reputable institutions with a track record of reliability and strong customer service.

- Contact the Provider: Once you’ve identified a provider, reach out to them to inquire about opening a trustee account or similar account. You can typically do this by visiting their website, calling their customer service line, or visiting a branch office if they have physical locations.

- Provide Documentation: To open a trustee account, you’ll likely need to provide certain documentation, such as identification documents for the trustee (the person managing the account) and any beneficiaries named in the account.

- Complete Application Forms: The provider may require you to complete application forms or paperwork to establish the trustee account. These forms will typically ask for personal information about the trustee and beneficiaries, as well as details about the account structure and management.

- Fund the Account: Once your application is approved and the account is set up, you may need to fund the account with an initial deposit. This can typically be done via a bank transfer, check, or electronic funds transfer (EFT) depending on the provider’s policies.

- Manage the Account: After the trustee account is established, the trustee will be responsible for managing the assets held in the account in accordance with the terms of the trust or other legal arrangements governing the account.

It’s important to note that the specific process for opening a trustee account may vary depending on the provider and the type of account you’re looking to create. Be sure to carefully review the provider’s requirements, terms, and conditions before proceeding with account creation. If you have specific questions or need assistance, don’t hesitate to reach out to the provider’s customer service team for guidance.

Faq Of Verified Trustee Plus Account

Specific information about a “Trustee Plus Account” and its frequently asked questions (FAQs), as it seems to be a term that lacks context or specificity within the financial industry.

However, if “Trustee Plus” refers to a particular type of account offered by a financial institution, investment firm, or service provider, the FAQs may vary depending on the features, benefits, and terms associated with that specific account.

Here are some general questions that may be included in the FAQs for a trustee account or a similar financial product:

- What is a Trustee Plus Account?

- Who can open a Trustee Plus?

- What are the benefits of a Trustee Plus?

- What documentation is required to open a Trustee Plus Account?

- Are there any fees associated with a Trustee Plus Account?

- How is the Trustee Plus managed?

- What investment options are available within the Trustee Plus Account?

- Can additional beneficiaries be added to the Trustee Plus Account?

- What happens in the event of the trustee’s incapacitation or passing?

- Is the Trustee Plus insured or protected by any regulatory agencies?

It’s important to note that the specific FAQs for a Trustee Plus Account or similar financial product will depend on the provider and the terms and conditions associated with the account. Individuals interested in opening a Trustee Plus should review the provider’s documentation, website, or contact their customer service team for detailed information and clarification on any questions they may have.

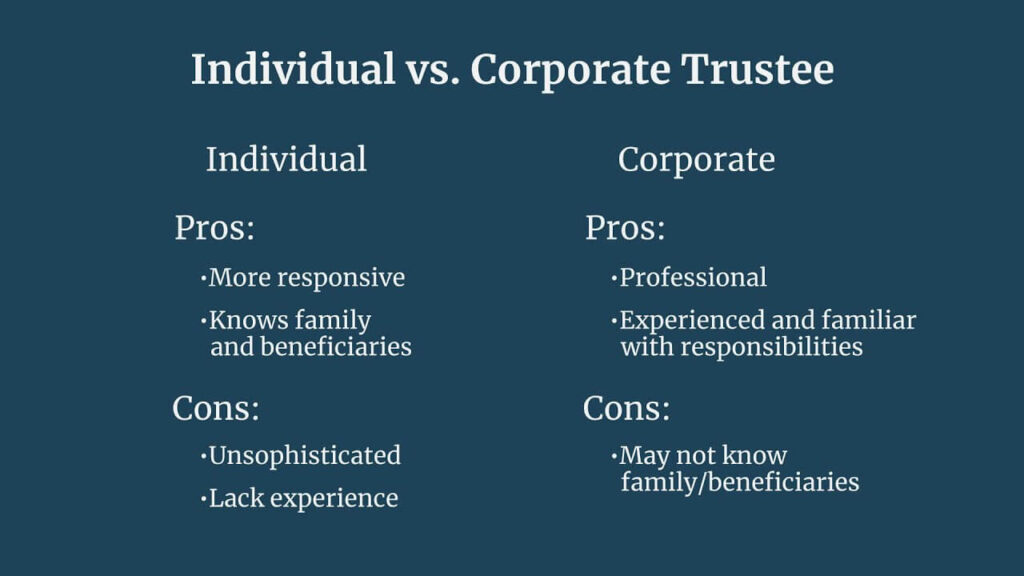

Pros And Cons Of Verified Trustee Plus Account

A “Trustee Plus” may refer to a specific type of financial account offered by a financial institution or investment firm, designed for trustees managing assets on behalf of beneficiaries.

Here are some potential pros and cons associated with Trustee Plus Accounts:

Pros:

- Enhanced Features: Trustee Plus Accounts may offer enhanced features compared to standard trustee accounts, such as higher transaction limits, access to premium investment opportunities, and additional financial planning services.

- Comprehensive Asset Management: Trustee Plus Accounts often provide comprehensive asset management services, allowing trustees to effectively manage and invest assets on behalf of beneficiaries, including portfolio diversification and risk management.

- Investment Flexibility: Trustee Plus Accounts may offer trustees greater flexibility in investment choices, allowing them to invest in a broader range of asset classes, including stocks, bonds, mutual funds, and alternative investments.

- Professional Guidance: Trustee Plus Accounts may provide access to professional financial advisors or investment managers who can offer personalized guidance and investment strategies tailored to the specific needs and goals of the trust and its beneficiaries.

- Consolidated Reporting: Trustee Plus Accounts may offer consolidated reporting and account management tools, providing trustees with a comprehensive overview of account activity, investment performance, and tax reporting for easier administration.

Cons:

- Higher Fees: Trustee Plus Accounts may come with higher account maintenance fees, investment management fees, and other associated costs compared to standard trustee accounts, which can reduce overall returns and impact the value of the trust.

- Complexity: Trustee Plus Accounts may involve additional complexity in terms of account structure, investment options, and regulatory compliance requirements, which could be challenging for trustees to navigate, particularly if they lack financial expertise.

- Risk of Underperformance: While Trustee Plus Accounts may offer access to a broader range of investment opportunities, there is also a risk of underperformance or loss of principal, especially in volatile market conditions or if investment decisions are not well-informed or properly managed.

- Potential Conflicts of Interest: Trustees managing Trustee Plus Accounts may face potential conflicts of interest, particularly if they have personal or financial interests that conflict with the best interests of the trust beneficiaries, requiring careful management and transparency.

- Regulatory Compliance: Trustee Plus Accounts are subject to regulatory oversight and compliance requirements, which may vary depending on the jurisdiction and the type of assets held within the account. Trustees must ensure that they adhere to all relevant laws and regulations governing trust administration and investment management.

Before opening a Trustee Plus or making any investment decisions on behalf of a trust, trustees should carefully consider the potential advantages and drawbacks of such accounts and seek professional advice to ensure that they are acting in the best interests of the trust beneficiaries.

Security Of Buy Verified Trustee Plus Accounts

The security of a Trustee Plus Account primarily depends on the financial institution or trustee managing the account, as well as the measures put in place to safeguard assets and sensitive information.

Here are some key aspects of security that are typically associated with Trustee Plus Accounts:

- Regulatory Compliance: Trustee Plus Accounts are often subject to regulatory oversight and compliance requirements to ensure that the trustee operates within legal and ethical boundaries. Compliance with regulatory standards helps protect account holders and ensures the integrity of the financial system.

- Encryption and Data Protection: Financial institutions and trustees typically employ robust encryption protocols to secure sensitive information and transactions associated with Trustee Plus. Encryption helps prevent unauthorized access to account data and safeguards personal and financial information from cyber threats.

- Access Controls: Trustee Plus may incorporate access controls such as multi-factor authentication (MFA) and role-based permissions to limit access to authorized individuals only. Access controls help prevent unauthorized users from accessing account information or making unauthorized transactions.

- Physical Security: Financial institutions often have physical security measures in place to protect assets held in Trustee Plus. This may include secure facilities, surveillance systems, and restricted access to sensitive areas where account data is stored.

- Risk Management: Trustee Plus are subject to comprehensive risk management practices designed to identify, assess, and mitigate potential threats to account security. Risk management frameworks help protect assets from fraud, theft, and other risks that may arise in the course of trust administration.

- Audit Trails and Monitoring: Financial institutions and trustees may implement audit trails and monitoring systems to track account activity, detect suspicious behavior, and identify potential security breaches. Continuous monitoring allows for timely response to security incidents and helps maintain the integrity of Trustee Plus Accounts.

- Professional Expertise: Trustees managing Trustee Plus often have professional expertise and experience in trust administration, investment management, and financial planning. Their expertise helps ensure that assets are managed prudently and in accordance with the terms of the trust, enhancing overall account security and performance.

Overall, the security of a Trustee Plus is a multifaceted aspect that involves a combination of technological, procedural, and organizational measures to protect assets and maintain the trust and confidence of account holders. By adhering to industry best practices and regulatory requirements, financial institutions and trustees can mitigate risks and provide a secure environment for managing and preserving wealth.

Verified Trustee Plus Accounts Supported Country

The availability of Trustee Plus Accounts or similar financial products may vary depending on the financial institution, investment firm, or service provider offering them. Generally, Trustee Plus may be available in countries where trust structures are commonly used for estate planning, wealth management, and asset protection purposes.

The availability of Trustee Plus Accounts may also be influenced by regulatory requirements, legal frameworks, and market demand in specific countries. Financial institutions and investment firms offering Trustee Plus typically operate within the legal and regulatory framework of the countries where they are established or licensed to provide financial services.

Some countries with well-established financial markets and legal systems conducive to trust administration and asset management may have a broader range of options for Trustee Plus. These may include countries with robust financial centers such as the United States, the United Kingdom, Switzerland, Singapore, and others.

However, it’s important to note that the availability and specific features of Trustee Plus Accounts may vary by jurisdiction, and not all countries may offer these types of accounts or similar trustee services.

Individuals interested in opening a Trustee Plus should research financial institutions and investment firms operating in their country or in jurisdictions where they intend to establish trust structures. They should also consult with legal and financial advisors to understand the regulatory requirements, tax implications, and suitability of Trustee Plus based on their individual circumstances and financial goals.

Why People Looking For Verified Trustee Plus Accounts

People may seek Trustee Plus Accounts for several reasons, depending on their financial goals, estate planning needs, and investment objectives.

Here are some common reasons why individuals may consider opening a Trustee Plus Account:

- Asset Protection: Trustee Plus Accounts can provide a mechanism for protecting assets and preserving wealth for future generations. By placing assets into a trust, individuals can shield them from creditors, legal liabilities, and potential claims, ensuring that they are available to beneficiaries according to the terms of the trust.

- Estate Planning: Trustee Plus Accounts are often used as part of comprehensive estate planning strategies to facilitate the orderly transfer of assets to heirs and beneficiaries upon the grantor’s passing. Trust structures allow individuals to specify how assets should be distributed, manage tax liabilities, and minimize the administrative burden on heirs.

- Wealth Management: Trustee Plus Accounts offer sophisticated wealth management solutions tailored to the needs of high-net-worth individuals, families, and organizations. Trustee services may include investment management, asset allocation, portfolio diversification, and ongoing financial planning to help preserve and grow wealth over time.

- Privacy and Confidentiality: Trustee Plus Accounts can provide a level of privacy and confidentiality that may not be available through other means of asset ownership. Trust structures allow individuals to maintain anonymity and discretion regarding their financial affairs, protecting sensitive information from public disclosure.

- Flexibility and Control: Trustee Plus Accounts offer flexibility and control over the management and distribution of assets held within the trust. Grantors can specify detailed instructions regarding how assets should be managed, distributed, and used for the benefit of beneficiaries, allowing for customization based on individual preferences and objectives.

- Tax Efficiency: Trustee Plus Accounts may offer tax advantages and efficiencies, depending on the jurisdiction and the specific terms of the trust. Trust structures can help minimize estate taxes, capital gains taxes, and other tax liabilities, allowing individuals to maximize the value of their assets for themselves and their heirs.

- Legacy Planning: Trustee Plus Accounts enable individuals to create a lasting legacy and impact by supporting charitable causes, philanthropic endeavors, and community initiatives through dedicated trust funds and endowments. Trust structures allow individuals to leave a meaningful and lasting impact on future generations.

Overall, Trustee Plus Accounts provide a comprehensive and customizable framework for individuals to protect, manage, and transfer their wealth in accordance with their values, goals, and priorities. By leveraging the benefits of trust structures, individuals can create financial legacies that endure for generations to come.

“Unlock Wealth Protection and Growth with Trustee Plus Accounts”

Are you seeking comprehensive solutions to safeguard and grow your wealth while ensuring a seamless transfer to future generations? Look no further than Trustee Plus Accounts. Designed for individuals, families, and organizations with complex financial needs, Trustee Plus Accounts offer a sophisticated framework for asset protection, estate planning, and wealth management.

Discover the Benefits of Trustee Plus Accounts:

- Asset Protection: Trustee Plus Accounts provide a robust shield against creditors, legal liabilities, and potential claims, preserving your hard-earned assets for the benefit of your loved ones. With a Trustee Plus Account, you can safeguard your wealth and enjoy peace of mind knowing that your assets are secure.

- Estate Planning Excellence: Trustee Plus Accounts are instrumental in crafting comprehensive estate plans that reflect your wishes and priorities. By establishing a trust structure, you can dictate how your assets should be managed, distributed, and utilized to support your beneficiaries, minimizing tax liabilities and simplifying the transfer process.

- Tailored Wealth Management: With Trustee Plus, you gain access to tailored wealth management solutions designed to optimize your financial portfolio and achieve your long-term objectives. From strategic asset allocation to proactive investment strategies, our experienced trustees are dedicated to maximizing the growth potential of your assets.

- Privacy and Confidentiality: Trustee Plus Accounts afford you the luxury of privacy and confidentiality in your financial affairs. Trust structures allow you to maintain anonymity and discretion, safeguarding sensitive information from public scrutiny while preserving your family’s privacy.

- Tax Efficiency: Trustee Plus offer tax-efficient strategies to minimize estate taxes, capital gains taxes, and other tax liabilities, allowing you to retain more of your wealth and maximize the value of your assets for future generations.

- Flexibility and Control: With Trustee Plus Accounts, you retain flexibility and control over the management and distribution of your assets. Tailor your trust provisions to align with your unique preferences, values, and objectives, ensuring that your legacy reflects your vision for the future.

Experience the Power of buy Trustee Plus Account Today!

Don’t leave your financial legacy to chance. Embrace the advantages of Trustee Plus and unlock a world of possibilities for wealth protection, growth, and preservation. Whether you’re planning for retirement, safeguarding your family’s future, or leaving a lasting impact on the world, Trustee Plus provide the framework you need to achieve your financial goals.

Contact us today to learn more about Trustee Plus Accounts and embark on a journey towards financial prosperity and peace of mind. Your legacy begins with Trustee Plus Accounts – secure your future today!

Summary Of Verified Trustee Plus Account

A Trustee Plus is a sophisticated financial product designed to provide individuals, families, and organizations with comprehensive solutions for wealth protection, estate planning, and wealth management.

Here’s a summary of key points regarding Trustee Plus Accounts:

- Asset Protection: Trustee Plus Accounts offer a robust shield against creditors, legal liabilities, and potential claims, ensuring that assets are safeguarded for the benefit of beneficiaries.

- Estate Planning Excellence: Trustee Plus Accounts play a pivotal role in crafting comprehensive estate plans, allowing individuals to dictate how assets should be managed, distributed, and utilized to support beneficiaries while minimizing tax liabilities.

- Tailored Wealth Management: Trustee Plus Accounts provide access to tailored wealth management solutions, including strategic asset allocation, investment optimization, and proactive financial planning to maximize growth potential.

- Privacy and Confidentiality: Trustee Plus Accounts afford individuals privacy and confidentiality in their financial affairs, allowing them to maintain anonymity and discretion while preserving family privacy.

- Tax Efficiency: Trustee Plus Accounts offer tax-efficient strategies to minimize estate taxes, capital gains taxes, and other tax liabilities, enabling individuals to retain more of their wealth for future generations.

- Flexibility and Control: With Trustee Plus Accounts, individuals retain flexibility and control over the management and distribution of assets, tailoring trust provisions to align with unique preferences, values, and objectives.

Overall, Trustee Plus Accounts provide a powerful framework for individuals to protect, manage, and transfer their wealth in accordance with their financial goals and priorities. By leveraging the benefits of trust structures and comprehensive wealth management solutions, individuals can secure their financial legacies and leave a lasting impact on future generations.

Are you looking to buy trustee plus account?

We offer verified trustee plus account for sale. You can buy trustee plus account from us.

In This Service, You’ll Get:

- Login Details

- Mail Access

Delivery Time:

Usually, to deliver accounts for sale we take 3 to 5 hours and a maximum of up to 24 to 48 hrs. Also, it depends on stock availability. So make sure to note the delivery time frame.

Warranty/Replacement:

We provide 24h replacement guarantee for accounts after delivery. So If the account gets closed or didn’t log in within 24 hours, Please contact Telegram.

The account won’t be replaced or refunded if you change your password or username or do any action prohibiting the platform is used.

We are not responsible for blocks, bans, etc after you start using the accounts, it’s your own responsibility.

Benefits From Us:

If you want to for your business, then your first choice would be our company. We guarantee 100% of our services. High-quality services, Replacements guarantee, and old – new accounts. We accept payment methods like USDT, BTC, and LTC. If our deal is canceled or any problem occurs, we give a 100% money-back guarantee.

Reviews

There are no reviews yet.