Buy Verified Remitly Account

A Remitly Account is a powerful tool that provides users with a central platform to initiate, track, and manage international money transfers. By signing up for a Remitly Account, you gain access to a range of features and benefits that make sending money abroad easier and more convenient.

Here are some key features and aspects of a Remitly Account:

User Registration: In order to open a Remitly account, users need to register on either the Remitly website or mobile app and provide personal data such as their name, address, contact details and sometimes identification documents based on regulatory requirements.

User Registration: In order to open a Remitly account, users need to register on either the Remitly website or mobile app and provide personal data such as their name, address, contact details and sometimes identification documents based on regulatory requirements.

Secure Login: Once registered, users can securely log in to their Remitly Account using their chosen username/email address and password combination. Remitly may offer additional security measures like two-factor authentication for extra protection.

Establishing a Transfer is a straightforward process within your Remitly Account dashboard. You’ll need to provide the recipient’s details, transfer amount, and destination country, as well as select the desired delivery method and currency of the recipient.

Here’s how you can do it:

Tracking your transfers is a key feature of your Remitly Account. It allows you to monitor the status of your transfers in real time, providing you with peace of mind and keeping you informed about your money’s journey. Here’s how it works:

Remitly Account simplifies the management of all payment methods linked to your account, such as bank accounts, debit cards, and credit cards. You can add, modify, or remove payment methods as necessary, giving you a sense of organization and control.

Users can easily view their transaction history within their Remitly Account, providing a comprehensive record of past transfers including dates, recipients, amounts, and delivery statuses. This transparency helps you stay informed and confident about your transactions.

Remitly Account offers customers access to robust customer support services. This ensures that you can always reach out for assistance, resolve any issues that arise with your transfers, or seek clarification regarding account-related matters, making you feel supported and cared for.

Remitly employs stringent security measures to safeguard user accounts and sensitive data, such as encryption, identity verification, and fraud detection systems.

Remitly Account provides an efficient platform for international money transfers, offering users convenience, transparency, and security when sending funds abroad.

How to Open a Remitly Account:

How to Open a Remitly Account:

In order to open and start sending money internationally with Remitly, here are the general steps:

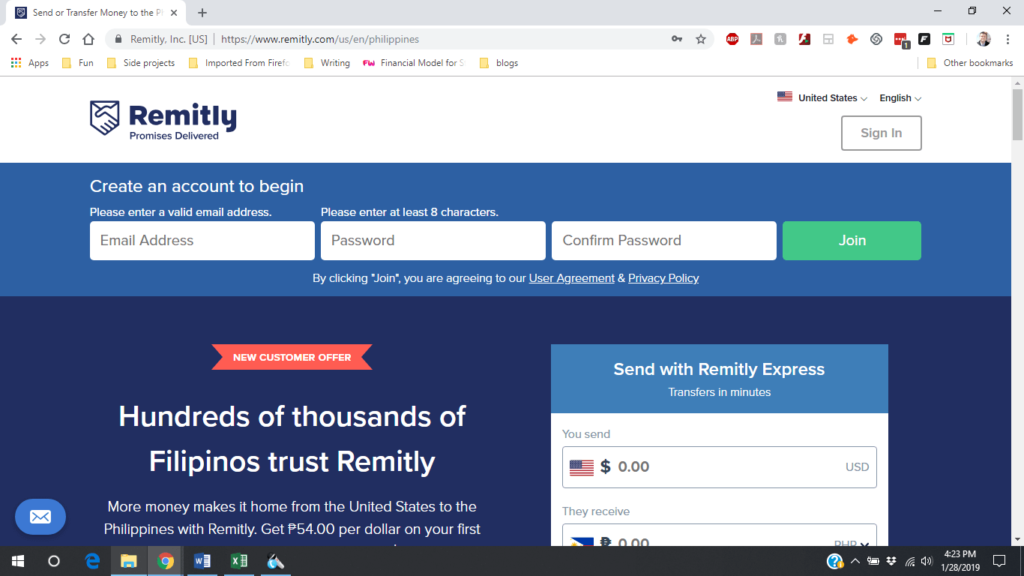

Visit Remitly’s Website or Download Their Mobile App: If you would like to create a Remitly account, either visit www.remitly.com or download its mobile app from either Apple’s App Store (iOS devices) or Google’s Play Store (Android devices).

Sign Up: Once you’ve access to Remitly, look for it and click on “Sign Up” or “Get Started” to begin creating an account.

Provide Your Information: Complete all required fields with your details, such as your full name, email address, phone number and residential address. Be accurate, as this data will be used for verification.

Verify Your Identity: Remitly may require that you go through an identity verification process in order to meet regulatory requirements, which may involve providing documentation such as a government-issued ID, passport or driver’s license.

Establish Your Remitly Account: Select a username and password for your Remitly Account, and choose one with letters, numbers, and special characters to provide maximum protection.

Select Your Recipient Country: Select the country where you intend to send money. Remitly supports transfers to over 100 nations worldwide; choose one for your transfer.

Select Your Transfer Method: Determine your transfer method of choice from bank deposit, cash pickup or mobile wallet – each will have different fees and processing times associated with them.

Enter Your Transfer Details: Fill in all necessary details about your transfer, such as the recipient’s name and contact info, as well as bank account (if applicable) information (if any). Also, enter any amount to send along with the currency options that are available to you.

Review and Confirm: After reviewing all the information provided to ensure accuracy, confirm your transfer in order to initiate it and begin its transaction.

Fund Your Transfer: Choose your preferred payment method when funding your transfer with Remitly – bank accounts, debit cards and credit cards are among our accepted payment options.

Follow the Prompts: To complete the transfer process, follow the prompts. Upon submitting, you’ll receive confirmation and tracking information for your transfer so that you can monitor its journey until it reaches its recipient.

All set! Once you’ve followed these steps, you will have successfully created a Remitly Account and initiated your first international money transfer. Please keep in mind that specific requirements may differ slightly based on where you live and the services offered by Remitly in your country.

FAQ of Verified Remitly Accounts

FAQs about Remitly Accounts cover various aspects of their platform’s services, account management, transaction process, fees and security measures – here are some common ones:

Please provide an overview of Remitly and its services, emphasizing its role as an international money transfer platform.

How Can I Create My Remitly Account?

Please show me the steps required to create a Remitly account, such as providing personal details, verifying identity and setting up account details.

What countries can I send money through Remitly?

Remitly supports money transfers to many countries around the world, including popular destinations for international remittances.

What fees apply when using Remitly?

Provide details regarding Remitly’s fees, such as transfer and exchange rate margin charges. Also, provide any charges associated with using its platform.

How long will it take for my transfer to reach its recipient?

Please outline typical processing times for Remitly transfers, which may differ depending on factors like recipient country, the delivery method chosen and payment processing.

Which payment methods can I use to fund my transfers?

Remitly accepts numerous payment options, such as bank accounts, debit cards, credit cards and electronic payment solutions.

Are You Wondering If Remitly Is Secure?

It reviews Remitly’s Security Features, Such As Encryption, Identity Verification and Fraud Detection to Secure User Accounts and Transactions.

Can I Change or Cancel my Transfer Once it Has Been Started?

Detail the policies and procedures for canceling or amending transfers, including any applicable deadlines and fees.

What happens if there’s an issue with my transfer?

Provide instructions for users who require assistance with transfer-related inquiries, refund requests or any other concerns.

Is there a maximum limit to how much can be sent through Remitly?

Discuss any restrictions or limits to how much money users can send via Remitly, including daily, weekly, or monthly transfer limits.

These are some examples of questions you might find included in a Remitly Account FAQs document. However, these could vary depending on Remitly’s services, policies, and user needs. By offering comprehensive answers to frequently asked questions (FAQs), Remitly can better help users understand how best to utilize its services while assuaging any concerns they might have regarding their Remitly Account or transactions.

Here are the pros and cons associated with purchasing a Remitly Account to facilitate international money transfers:

Here are the pros and cons associated with purchasing a Remitly Account to facilitate international money transfers:

Remitly is an efficient and user-friendly platform for sending money internationally, offering flexible transfer options online or via the Remitly mobile app. Users can initiate international money transfers with ease.

Pros:

Speed: Remitly transfers are generally processed quickly, with funds reaching their intended recipient within minutes or hours, depending on delivery method and country of destination.

Remitly’s broad reach makes it accessible for individuals sending money abroad, with over 100 countries supporting it at present, allowing money transfers between locations around the globe.

Remitly offers highly competitive exchange rates for international money transfers, enabling users to get maximum value out of their remittances.

Remitly’s Transparency Regarding Transfer Fees and Exchange Rate Margin Margin allows users to know exactly how much their transfers will cost upfront.

Multiple Delivery Methods: Users have various delivery options available to them when sending money transfers, such as bank deposits, cash pickups, mobile wallets and home delivery based on recipient preferences and location.

Cons:

Limited Payment Methods:

Remitly may restrict which funding transfer options it accepts depending on a user’s location and service offerings. Among them may be bank accounts, debit cards or credit cards as viable payment solutions.

Remitly may impose transfer limits that restrict how much users can send through its platform, which could affect those with more extensive transfer needs.

Fees Associated with Express Transfers: While Remitly offers both standard and express transfer options, express transfers typically incur higher fees compared to standard ones, which could impact the total cost of the transaction.

Compliance Requirements: Users may be required to go through identity verification and comply with regulatory requirements such as anti-money laundering (AML) and Know Your Customer (KYC), adding another level of complexity during account setup.

Exchange Rate Fluctuations: Remitly is subject to currency exchange rate fluctuations that could alter the amount received by recipients if processing takes longer than anticipated.

Remitly’s services may not be available in all countries or regions, limiting accessibility for individuals in specific locations.

Overall, Remitly Account offers an efficient and user-friendly method to transfer money internationally. Still, users should take note of any fees, transfer limits or delivery options when making their decision.

Security of Verified Remitly Account for Sale

Security of Verified Remitly Account for Sale

Remitly prioritizes the security of its users’ accounts and personal information by employing various measures designed to minimize risks and protect against unauthorized access or fraudulent activities.

Here are some critical aspects of the security measures used:

Encryption: Remitly employs industry-standard encryption protocols to safeguard data transmission between user devices and its servers, protecting sensitive information such as login credentials and financial details from being intercepted by third parties.

Two-Factor Authentication (2FA): Remitly provides two-factor authentication as an extra layer of protection for user accounts. Users can activate two-factor authentication by providing their primary password as well as providing a secondary verification code – typically sent directly to their phone – whenever logging in.

Remitly may require users to go through identity verification processes in order to comply with regulatory requirements, which helps verify they are who they claim they are and protects against identity theft and fraud. This verification procedure helps ensure users are who they say they are while also helping prevent theft and fraud from taking place.

Fraud Detection: Remitly utilizes sophisticated fraud detection algorithms and monitoring systems to identify suspicious activities or any potential instances of fraud, including transaction patterns analysis, anomaly detection and taking appropriate measures to mitigate risks.

Secure Payment Processing: Remitly is proud to partner with leading financial institutions and payment processors to offer safe payment transactions for users, safeguarding their financial data according to industry standards.

Regular Security Audits: Remitly conducts regular security audits and assessments in order to identify vulnerabilities, evaluate risks, and strengthen its security infrastructure proactively in order to remain resilient against emerging threats and vulnerabilities. This proactive approach ensures that its platform remains resilient against emerging vulnerabilities and threats.

Customer Education: Remitly educates its users on best security practices and guides them on how to protect their accounts and personal data.

It also provides:

- Tips for creating strong passwords.

- Recognizing phishing attempts.

- Guarding against social engineering attacks.

Compliance with Regulatory Standards: Remitly operates in full accordance with applicable financial services industry laws and regulations, such as anti-money laundering (AML) and know-your-customer (KYC). Our commitment to compliance ensures users remain protected while upholding the integrity of the platform.

Remitly’s security measures adhere to industry standards and best practices, offering users a secure environment in which to send money internationally or manage financial transactions with confidence. However, users play an equally crucial role in maintaining account security by following security recommendations and being vigilant against potential threats.

Verified Remitly Account Supported Country

Remitly provides international money transfers to over 100 countries globally. While its list may change according to regulatory changes and business developments, Remitly typically supports transfers to this many destinations.

Remitly’s top recipient countries for transfers typically encompass countries in Asia, Latin America, Africa, Europe and other regions – such as India, Mexico, the Philippines, Nigeria, Colombia, Vietnam, Guatemala, Pakistan, and El Salvador.

Remitly’s website or mobile app should always provide users with up-to-date information regarding supported countries and transfer corridors, including any changes due to regulatory requirements, banking partnerships or market demand.

Remitly’s services for sending money may differ depending on where the sender resides and which services are offered in their region.

Remitly’s mission is to offer accessible and convenient money transfer services for users sending funds across borders while adhering to principles of transparency, speed, and affordability.

Why People Looking For Buy Verified Remitly Accounts

People turn to Remitly Account for several reasons. Remitly provides a convenient method of international money transfers without leaving home or on the go via their mobile app, making it possible to initiate transfer requests at any time, from anywhere, without visiting physical locations in person.

Speed: Remitly offers fast transfer times, with many transactions completed within minutes or hours, depending on the delivery method and country selected for receiving money transfers. This quick speed makes Remitly ideal for individuals needing to send money quickly for family support purposes or meeting urgent financial obligations.

Remitly’s cost-effective transfer options help users maximize the value of their remittances while saving money on exchange and transfer fees and currency exchange costs.

Remitly is accessible: Remitly offers transfers to over 100 countries worldwide, making it accessible for individuals sending funds across regions or destinations. Their extensive network of partner banks and payout locations ensures that recipients can easily access funds. Remitly cares for its customers’ financial data with discretion while following industry best practices for security practices.

Customer Support: Remitly provides responsive customer support services to assist users with any questions, concerns, or issues they encounter during the transfer process. Whether that means troubleshooting technical issues or providing assistance with transaction inquiries, Remitly’s customer support team is ready to provide support whenever needed.

Remitly is committed to complying with relevant laws and regulations governing the financial services industry, such as anti-money laundering (AML) and know-your-customer (KYC) requirements, so users can trust that their transfers are being processed in line with these standards.

People choose Remitly Account due to its convenience, speed, affordability, security and reliability. From sending funds overseas for family support purposes or paying bills to make purchases, Remitly provides an efficient and safe means of international money transfers.

Unlock Seamless International Money Transfers with Remitly Account.

Remitly Account makes international money transfers simple, fast, and reliable for individuals – offering an efficient platform to send funds overseas to loved ones or cover various financial needs.

Why Use a Remitly Account When Sending Money Abroad?

Remitly Account Offers Convenience at Your Fingertips: With Remitly, sending money abroad couldn’t be simpler! No more waiting in line at physical locations or dealing with cumbersome paperwork – their user-friendly platform lets you initiate transfers anytime, anywhere, directly from your computer or mobile device!

Remitly Offers Fast Transfers and Instant Relief: Time is of the utmost importance when sending money overseas, and many transfers with Remitly can be completed within minutes, providing your loved ones with funds when they most require them.

Remitly offers global reach with local connections: Remitly provides access to over 100 destinations worldwide for money transfers, making Remitly an essential service whether supporting family back home or conducting international transactions for business.

Transparent and Competitive Rates: With Remitly, there are no hidden fees or confusing exchange rates – what you see is what you get – offering transparent pricing and highly competitive exchange rates so that your hard-earned cash goes where it counts. You can rest easy knowing your hard-earned money is going where it counts!

Robust Security Measures: Your safety is always our number one concern, which is why Remitly Account utilizes cutting-edge encryption technology and stringent security protocols to protect both personal and financial information. With Remitly Account, you can send money with complete peace of mind, knowing that every aspect of your transaction will be safely safeguarded every step of the way.

Launch Your Remitly Account Today!

Join the millions of satisfied customers who trust Remitly Account for all their international money transfer needs. Opening an account is quick, simple, and hassle-free; enjoy the ease and peace of mind associated with sending funds through Remitly.

Don’t let distance keep you from supporting loved ones or achieving financial goals; with Remitly Account, all corners of the globe are within your grasp!

Sign up now for a Remitly Account and begin the journey towards efficient international money transfers!

This SEO-friendly content highlights the key benefits and features of Remitly Account, such as convenience, speed, global reach, transparent pricing structure, security measures and ease of use. It aims to engage users looking for reliable international money transfers while optimizing search engine visibility.

Summary Of Remitly Account

Remitly Account provides an intuitive platform to send money internationally to family and friends or to fulfill various financial needs. Remitly Account allows users to initiate transfers quickly and conveniently from either their computer or mobile device, with most completed in just minutes. Its vast network spans over 100 countries and regions, allowing users to connect worldwide. Remitly Account offers transparent and competitive pricing, robust security measures to protect user information, and seamless integration with various payment methods. It simplifies money transfer between countries – delivering speed, convenience and peace of mind to users globally.

Are you looking to buy remitly account?

We offer verified remitly account for sale. You can buy remitly account from us.

In This Service, You’ll Get:

- Login Details

- Mail Access

Delivery Time

Usually, to deliver accounts for sale we take 3 to 5 hours and a maximum of up to 24 to 48 hrs. Also, it depends on stock availability. So make sure to note the delivery time frame.

Warranty/Replacement

We provide 24h replacement guarantee for accounts after delivery. So If the account gets closed or didn’t log in within 24 hours, Please contact Telegram.

The account won’t be replaced or refunded if you change your password or username or do any action prohibiting the platform is used.

We are not responsible for blocks, bans, etc after you start using the accounts, it’s your own responsibility.

Benefits From Us

If you want to for your business, then your first choice would be our company. We guarantee 100% of our services. High-quality services, Replacements guarantee, and old – new accounts. We accept payment methods like USDT, BTC, and LTC. If our deal is canceled or any problem occurs, we give a 100% money-back guarantee.

Reviews

There are no reviews yet.