Buy verified PST Account:

There isn’t a widely recognized financial service or account called a “PST Account.” However, “PST” can stand for various things in different contexts:

- Pacific Standard Time: This is a time zone commonly used in the western United States and Canada.

- Provincial Sales Tax: In some regions, “PST” refers to Provincial Sales Tax, which is a consumption tax levied by Canadian provinces on goods and services.

- Personal Savings Tax: This could refer to a tax on personal savings or investment income, which varies depending on jurisdiction and the specific tax laws in place.

- Paysend: There might be a typo or confusion with “Paysend,” a financial service that offers international money transfers and digital banking solutions. In this case, a Paysend account allows users to send money internationally and manage their finances digitally.

Without more context, it’s challenging to determine precisely what “PST Account” refers to. If you have specific information or context about the term, please provide it, and I’d be happy to offer more assistance.

How to create Buy Verified PST Account:

There isn’t a widely recognized financial service or account known specifically as a “PST Account.” However, if you’re referring to a personal savings or checking account with a bank or financial institution, the process typically involves the following steps:

- Research Financial Institutions: Start by researching different banks or credit unions to find one that meets your needs in terms of services offered, fees, interest rates, and convenience of access.

- Choose the Type of Account: Decide whether you want a savings account, checking account, or a combination of both. Each type of account serves different purposes and may have varying features and requirements.

- Gather Required Documents: When you’re ready to open an account, you’ll typically need to provide personal identification documents such as a driver’s license, passport, or government-issued ID. You may also need to provide proof of address and other relevant information.

- Visit the Bank or Apply Online: You can either visit the bank branch in person or apply for an account online, depending on the bank’s offerings and your preferences. If applying online, you’ll usually need to fill out an application form on the bank’s website.

- Deposit Funds: Some accounts may require an initial deposit to open, while others may not. Be prepared to fund your account with the required amount of money.

- Review and Accept Terms: Carefully review the terms and conditions of the account, including any fees, minimum balance requirements, and other important details. Make sure you understand and agree to the terms before proceeding.

- Complete the Account Opening Process: Follow the instructions provided by the bank to complete the account opening process. This may include signing documents electronically or in person, setting up account preferences, and choosing additional services if applicable.

- Receive Account Information: Once your account is approved and opened, you’ll receive account information such as your account number, routing number (if applicable), and other details needed to access and manage your account.

- Start Using Your Account: You can now start using your PST account to deposit money, make withdrawals, pay bills, and manage your finances according to your needs and preferences.

Remember to keep your account information secure and monitor your transactions regularly to detect any unauthorized activity. Additionally, feel free to contact the bank’s customer service if you have any questions or need assistance with your account.

Faq of Buy Verified PST Accounts:

Here are some frequently asked questions (FAQ) that might be associated with a PST (Personal Savings or Checking) Account:

-

What is a PST Account?

- A PST Account typically refers to a Personal Savings or Checking Account offered by banks or financial institutions. It’s a place where individuals can deposit money, earn interest (in the case of savings accounts), and perform various financial transactions.

-

How do I open a PST Account?

- To open a PST Account, you typically need to visit a bank branch or apply online, depending on the bank’s procedures. You’ll need to provide personal identification documents and possibly an initial deposit.

-

What documents do I need to open a PST Account?

- Commonly required documents include government-issued ID (passport, driver’s license), proof of address (utility bills, lease agreements), and Social Security Number (or equivalent).

-

Is there a minimum balance requirement for a PST Account?

- Minimum balance requirements vary depending on the bank and the type of account you choose. Some accounts may have no minimum balance requirement, while others may require you to maintain a certain balance to avoid fees.

-

What fees are associated with a PST Account?

- Fees associated with a PST Account may include monthly maintenance fees, overdraft fees, ATM fees, and fees for additional services like wire transfers or paper statements.

-

How can I access my PST Account?

- You can access your PST Account through various channels, including online banking, mobile banking apps, ATMs, bank branches, and telephone banking.

-

Can I link my PST Account to other accounts?

- Yes, you can often link your PST Account to other accounts within the same bank or with external financial institutions for easy fund transfers and transactions.

-

Is my money in a PST Account insured?

- In many countries, PST Accounts are insured by government agencies such as the Federal Deposit Insurance Corporation (FDIC) in the United States, up to a certain limit per account holder per bank.

-

How can I close my PST Account?

- To close your PST Account, you typically need to visit the bank branch or contact customer service. Make sure to withdraw any remaining funds and settle any outstanding transactions or fees before closing the account.

-

- If you lose your PST Account card or suspect unauthorized activity, contact your bank immediately to report the loss or fraudulent transactions. They will guide you through the necessary steps to protect your account and issue a new card if needed.

Remember, specific details and policies may vary depending on the financial institution and the type of account you have. It’s essential to review the terms and conditions of your PST Account and reach out to your bank if you have any questions or concerns.

Pros and cons of Buy Verified PST Account:

Here are some pros and cons of having a PST (Personal Savings or Checking) Account:

Pros:

- Convenience: PST Accounts offer convenient access to funds through various channels such as online banking, mobile apps, ATMs, and bank branches, allowing account holders to manage their finances anytime, anywhere.

- Safety and Security: Funds deposited in PST Accounts are typically insured by government agencies up to a certain limit, providing account holders with a level of financial protection against bank failures or losses.

- Financial Management: PST Accounts help individuals organize and manage their finances more effectively by providing tools and features such as transaction tracking, budgeting tools, and electronic statements.

- Interest Earnings: Savings accounts often accrue interest on deposited funds, allowing account holders to earn passive income on their savings over time.

- Payment Convenience: Checking accounts offer the flexibility to make payments easily through checks, debit cards, online bill pay, and electronic transfers, making it convenient to cover expenses and manage cash flow.

Cons:

- Fees: PST Accounts may come with various fees, including monthly maintenance fees, overdraft fees, ATM fees, and fees for additional services, which can eat into account holders’ balances over time.

- Minimum Balance Requirements: Some PST Accounts require account holders to maintain a minimum balance to avoid monthly fees or qualify for certain benefits, which can be challenging for individuals with limited funds.

- Interest Rates: While savings accounts offer interest earnings, the interest rates may be relatively low compared to other investment options, resulting in slower growth of savings over time, especially in periods of low-interest rates.

- Risk of Fraud and Theft: PST Account holders are susceptible to risks such as identity theft, fraud, and unauthorized transactions, especially if they do not monitor their accounts regularly or take adequate security measures.

- Limited Access to Funds: Savings accounts may impose restrictions on the number of withdrawals or transfers allowed per month, which can be inconvenient for account holders who need frequent access to their funds.

Overall, PST Accounts provide a secure and convenient way for individuals to manage their finances, but it’s essential to weigh the pros and cons and choose an account that aligns with your financial goals and needs. Additionally, being aware of fees, terms, and security measures can help account holders make informed decisions and protect their financial well-being.

Security of Verified PST Account for sale:

The security of a PST (Personal Savings or Checking) Account is a critical concern for both financial institutions and their customers. Here are some aspects of PST Account security:

- Encryption: Banks and financial institutions typically use encryption technology to protect sensitive data transmitted between the customer’s device and their servers. This helps ensure that account information, login credentials, and transaction details remain secure from interception by unauthorized parties.

- Multi-Factor Authentication (MFA): Many banks employ MFA methods to add an extra layer of security to account logins. This may involve requiring customers to provide a combination of factors such as a password, security questions, one-time passcodes sent to registered devices, or biometric data like fingerprints or facial recognition.

- Fraud Monitoring: Financial institutions often implement sophisticated fraud detection systems to monitor account activity for suspicious transactions or behavior. These systems can help identify and prevent unauthorized access or fraudulent activities in real-time, protecting customers from financial losses.

- Account Alerts: Banks may offer account alert services that notify customers of specific account activities, such as large withdrawals, low balances, or login attempts from unrecognized devices. Account holders can set up these alerts to monitor their accounts and quickly detect any unusual or unauthorized activity.

- Secure Access Channels: Banks provide secure access channels for customers to manage their accounts, including online banking portals, mobile apps, and telephone banking services. These channels are designed with security features and protocols to safeguard customer data and prevent unauthorized access.

- Regulatory Compliance: Financial institutions must adhere to regulatory standards and guidelines related to data security and privacy, such as the Payment Card Industry Data Security Standard (PCI DSS) and the Gramm-Leach-Bliley Act (GLBA). Compliance with these regulations helps ensure that customer information is handled and protected appropriately.

- Customer Education: Banks often provide resources and guidance to educate customers about best practices for securing their accounts and protecting themselves against fraud and identity theft. This may include tips on creating strong passwords, avoiding phishing scams, and staying vigilant against fraudulent schemes.

While banks and financial institutions take various measures to secure PST Accounts, customers also play a crucial role in maintaining the security of their accounts by practicing good cybersecurity habits and promptly reporting any suspicious activity to their bank. By working together, both financial institutions and customers can help mitigate risks and safeguard the integrity of PST Accounts.

Buy Verified PST Accounts Supported country:

“PST Account” isn’t a standardized financial term or service recognized globally. It seems to be an abbreviation that could refer to Personal Savings or Checking Account, but the specific countries where such accounts are supported would depend on the banks or financial institutions offering them.

Personal savings and checking accounts are common banking services offered by financial institutions worldwide. Therefore, the availability of PST accounts, under their respective names, would vary depending on the banking regulations and practices of each country.

In general, most countries have banking systems that offer personal savings and checking accounts to their residents and citizens. Some countries may have more developed banking infrastructures and a wider range of financial services, while others may have more limited options.

To determine which countries support PST accounts, you would need to look at specific banks or financial institutions operating in those countries and inquire about the types of accounts they offer. Additionally, international banks may provide accounts that can be accessed from multiple countries, although the availability of specific services may vary depending on local regulations and restrictions.

Why people looking for Buy Verified PST Accounts:

People may look for a PST (Personal Savings or Checking) Account for various reasons:

- Financial Management: PST Accounts offer a secure and convenient way to manage personal finances. They provide a centralized platform for depositing money, tracking expenses, and organizing transactions.

- Safety and Security: Keeping money in a PST Account reduces the risk of loss or theft compared to holding cash. Banks typically insure deposits up to a certain amount, providing a level of financial security to account holders.

- Interest Earnings: Savings accounts often accrue interest on deposited funds, allowing individuals to grow their savings over time. Checking accounts may not offer interest, but they provide convenient access to funds for everyday expenses.

- Payment Convenience: Checking accounts allow account holders to make payments easily through various channels such as checks, debit cards, online bill pay, and electronic transfers. This convenience simplifies financial transactions and cash management.

- Establishing Financial History: Having a PST Account can contribute to building a positive financial history and credit profile. Responsible account management, including timely bill payments and maintaining a healthy balance, can enhance creditworthiness and open doors to future financial opportunities.

- Access to Banking Services: PST Accounts often come with additional banking services such as direct deposit, overdraft protection, and access to loans and credit products. These services provide flexibility and financial support to account holders when needed.

- Financial Goals: People may open PST Accounts to work towards specific financial goals, such as saving for emergencies, major purchases, education, retirement, or travel. Having a dedicated account helps individuals track progress towards their goals and stay disciplined in their savings habits.

Overall, PST Accounts offer individuals a secure, flexible, and efficient way to manage their money, achieve financial objectives, and build a solid foundation for long-term financial well-being.

“Unlock Financial Freedom with a Personal Savings and Checking Account (PST Account)”

Are you looking for a reliable and secure way to manage your finances? A Personal Savings and Checking Account, commonly referred to as a PST Account, might be the solution you need to take control of your money and achieve your financial goals.

What is a PST Account?

A PST Account is a versatile banking tool that combines the benefits of a savings account and a checking account in one convenient package. With a PST Account, you can deposit your hard-earned money, earn interest on your savings, and enjoy easy access to funds for everyday expenses.

Key Features and Benefits:

- Safety and Security: Your money is safe and secure in a PST Account, protected by the rigorous security measures and regulations of your financial institution.

- Interest Earnings: Unlike traditional checking accounts, PST Accounts often earn interest on the funds you deposit. Watch your savings grow over time with competitive interest rates designed to maximize your earnings.

- Convenient Access: With online banking and mobile apps, accessing your PST Account has never been easier. Manage your finances on-the-go, check your balance, transfer funds, and pay bills with just a few taps on your smartphone or computer.

- Payment Flexibility: From paying bills to making purchases, your PST Account comes with the flexibility of a checking account. Write checks, use your debit card, or set up automatic payments to streamline your financial transactions.

- Financial Planning: Whether you’re saving for a rainy day or planning for the future, a PST Account helps you stay on track with your financial goals. Set up automatic transfers, create savings milestones, and monitor your progress with ease.

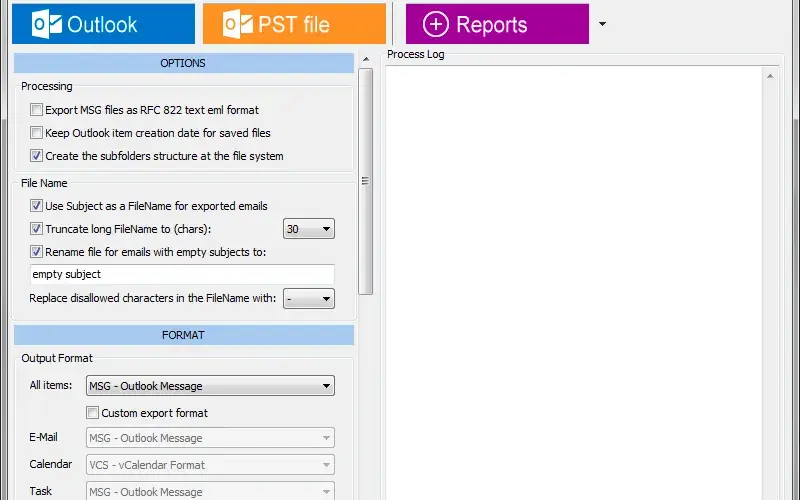

How to Open a buy PST Account:

Opening a PST Account is quick and easy. Simply visit your preferred bank or financial institution, and a friendly representative will guide you through the process. Provide some basic information, make an initial deposit, and voila – you’re ready to start banking smarter with your new PST Account.

Conclusion:

A PST Account offers the best of both worlds – the earning potential of a savings account and the convenience of a checking account. Take the first step towards financial freedom and open a PST Account today. With secure access, competitive interest rates, and flexible features, managing your money has never been more rewarding.

Unlock your financial potential with a Personal Savings and Checking Account – the smart choice for savvy savers and responsible spenders alike. Start banking smarter, start banking with a PST Account.

Summary of Buy Verified PST Accounts:

A PST (Personal Savings or Checking) Account provides individuals with a versatile banking solution that combines the features of both savings and checking accounts. With a PST Account, users can deposit funds securely, earn interest on savings, and access their money conveniently for everyday expenses. Key benefits include safety and security, interest earnings, convenient access through online and mobile banking, payment flexibility, and assistance with financial planning. Opening a PST Account is straightforward, typically requiring basic information and an initial deposit. In summary, a PST Account offers individuals a comprehensive way to manage their finances, save for the future, and achieve their financial goals effectively.

Reviews

There are no reviews yet.