Buy Verified Paytend Account

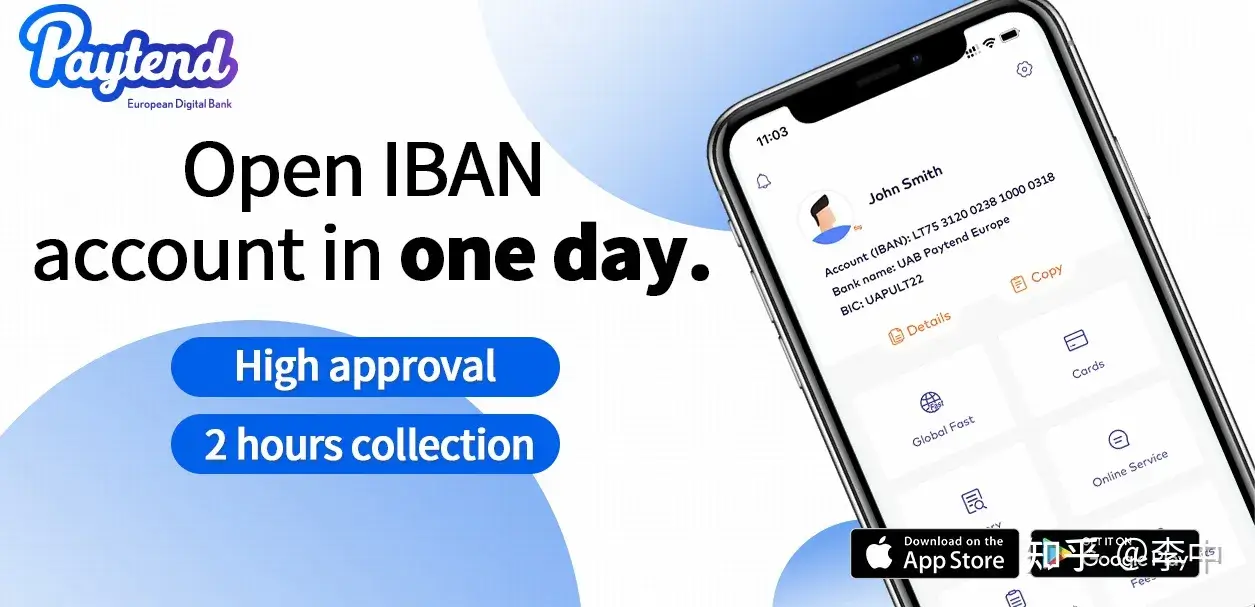

Paytend is a financial technology company that offers digital banking and payment solutions. A Paytend account is a type of digital wallet account provided by Paytend, allowing users to manage their finances, make payments, and access various banking services entirely online or through mobile applications.

Key features and services associated with a Paytend account may include:

- Digital Wallet: Paytend accounts function as digital wallets, enabling users to store funds securely in various currencies.

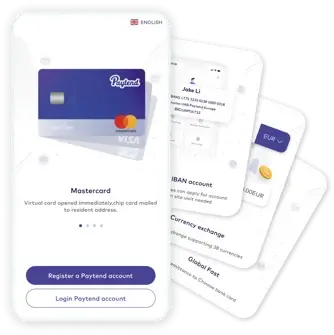

- Payment Solutions: With a Paytend account, users can make payments online, in-store, and through mobile devices using virtual or physical Paytend payment cards.

- Money Transfers: Paytend accounts typically facilitate money transfers between users, as well as to external bank accounts and other payment services.

- Budgeting and Spending Management: Paytend may offer features to help users track their spending, set budgets, and manage their finances more effectively.

- Multi-Currency Support: Paytend accounts may support multiple currencies, allowing users to hold and manage funds in different denominations.

- Security Measures: Paytend prioritizes security by implementing encryption, multi-factor authentication, and other advanced security measures to protect user accounts and transactions.

- Mobile Apps: Paytend provides mobile applications for iOS and Android devices, allowing users to access their accounts, make payments, and manage their finances on the go.

Overall, a Paytend account offers a convenient and flexible way for individuals and businesses to manage their money digitally, make payments, and access a range of financial services without the need for traditional banking infrastructure.

How To Buy Verified Paytend Accounts

To create a Paytend account, you typically need to follow these steps:

- Download the Paytend App: Start by downloading the Paytend mobile application from the App Store (for iOS devices) or Google Play Store (for Android devices).

- Install and Open the App: Once the Paytend app is downloaded, install it on your device and open it to begin the registration process.

- Sign Up for an Account: On the Paytend app, you’ll usually find an option to sign up or create a new account. Tap on this option to start the registration process.

- Provide Personal Information: You’ll be prompted to enter personal information such as your full name, date of birth, email address, and mobile phone number. Make sure to provide accurate information.

- Verify Your Identity: Depending on Paytend’s requirements and regulatory standards, you may need to verify your identity. This could involve providing a photo of a government-issued ID (such as a passport or driver’s license) and possibly additional documentation.

- Set Up Security Features: Choose a strong password for your Paytend account and consider enabling additional security features such as two-factor authentication (2FA) if available.

- Agree to Terms and Conditions: Review the terms and conditions of using Paytend’s services and agree to them if you accept.

- Complete Registration: After providing all necessary information and agreeing to the terms, complete the registration process. You may receive a confirmation email or message to verify your email address.

- Add Funds (If Required): Depending on your account type and intended use, you may need to add funds to your Paytend account. Paytend may support various funding methods such as bank transfers, credit/debit card payments, or cryptocurrency deposits.

- Explore Features: Once your account is set up and funded, you can explore the features of the Paytend app, such as making payments, transferring money, managing your budget, and accessing customer support.

It’s important to follow the instructions provided by Paytend during the registration process and ensure that you provide accurate information to avoid any delays or issues with account activation. Additionally, always review the terms and conditions of using Paytend’s services to understand your rights and obligations as a user.

Faq of Paytend Account

Here are some common questions that might be addressed in a Paytend account FAQ:

- How do I sign up for a Paytend account?

- What personal information do I need to provide to create a Paytend account?

- Is there a fee for opening a Paytend account?

- How do I verify my identity for my Paytend account?

- What features and services are included with a Paytend account?

- How do I add funds to my Paytend account?

- Are there any transaction limits for my Paytend account?

- Can I order a physical Paytend payment card?

- How do I activate my physical Paytend payment card?

- What security measures are in place to protect my Paytend account?

- How can I contact customer support if I have a question or issue with my Paytend account?

- Are there any fees associated with using my Paytend account or payment card?

- Can I use my Paytend account for international transactions?

- What do I do if my Paytend payment card is lost or stolen?

- Is my money protected if I lose access to my Paytend account?

These are just examples of potential questions that users might have about their Paytend accounts. The actual FAQ provided by Paytend may include additional questions and details specific to their services, policies, and user inquiries. It’s recommended to refer to the most current information available on the Paytend website or contact their customer support for assistance with specific questions or concerns.

Pros and cons of Verified Paytend Account

Here are some potential pros and cons of having a Paytend account:

Pros:

- Convenience: Paytend accounts offer users the convenience of managing their finances entirely online or through mobile applications. This includes making payments, transferring money, and accessing account information anytime, anywhere.

- Digital Wallet: Paytend functions as a digital wallet, allowing users to store funds securely and manage their money digitally. This eliminates the need for carrying physical cash or visiting brick-and-mortar banks.

- Payment Solutions: With Paytend, users can make payments online, in-store, and through mobile devices using virtual or physical Paytend payment cards. This offers flexibility and convenience in conducting transactions.

- Budgeting Tools: Paytend may offer features to help users track their spending, set budgets, and manage their finances more effectively. These tools can help users achieve their financial goals and improve their financial habits.

- Security Measures: Paytend prioritizes security by implementing encryption, multi-factor authentication, and other advanced security measures to protect user accounts and transactions. This helps safeguard user funds and personal information from unauthorized access.

Cons:

- Fees: While Paytend may offer certain features for free, there may be fees associated with certain transactions or account services, such as currency conversion fees, ATM withdrawals, or account maintenance fees. Users should review the fee structure carefully to understand the cost implications of using Paytend services.

- Dependence on Technology: Paytend accounts rely on technology and internet connectivity for access and functionality. Users may encounter issues or disruptions in service due to technical glitches, outages, or cyber threats.

- Regulatory Compliance: Users may be required to comply with regulatory requirements, such as identity verification procedures, to open and use a Paytend account. Failure to meet these requirements could result in limitations or restrictions on account functionality.

- Limited Accessibility: Paytend may not be available in all countries or regions, limiting accessibility for some individuals. Users should check the availability of Paytend services in their location before signing up for an account.

- Customer Support: While Paytend strives to provide excellent customer support, users may encounter challenges in accessing timely assistance or resolving issues, particularly during peak periods or in cases of complex inquiries.

Overall, the decision to open a Paytend account depends on individual preferences, financial needs, and the availability of Paytend services in their region. Users should weigh the pros and cons carefully and conduct thorough research to determine if Paytend aligns with their banking and payment needs.

Security of Verified Paytend Account for Sale

The security of a Paytend account is a crucial aspect, and Paytend typically employs various measures to ensure the protection of user funds and personal information. While specific security features may vary, here are common security measures associated with digital banking and payment services like Paytend:

- Encryption: Paytend uses strong encryption protocols to secure user data and communications. Encryption helps protect sensitive information during transmission between the user’s device and Paytend servers, making it difficult for unauthorized parties to access.

- Multi-Factor Authentication (MFA): Paytend often supports multi-factor authentication, adding an extra layer of security beyond passwords. Users may be required to verify their identity through additional steps, such as receiving a code on their mobile device or using biometric authentication.

- Secure Login: Paytend encourages users to create strong passwords and may enforce password complexity requirements. Additionally, Paytend may implement measures to detect and prevent unauthorized login attempts, such as account lockouts after multiple failed login attempts.

- Transaction Monitoring: Paytend monitors user account activity for unusual or suspicious behavior. Real-time transaction monitoring helps identify potential fraudulent activities, and users may receive alerts for certain transactions.

- Regulatory Compliance: Paytend adheres to regulatory standards, including anti-money laundering (AML) and know your customer (KYC) requirements. These measures help verify the identity of users and prevent illicit activities.

- Fraud Detection and Prevention: Paytend employs advanced fraud detection systems to identify and prevent fraudulent transactions. This may involve using machine learning algorithms and collaborating with financial institutions to stay ahead of emerging threats.

- Data Protection: Paytend implements robust data protection measures to safeguard user information against unauthorized access, disclosure, or misuse. Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), ensures the responsible handling of user data.

- Customer Education: Paytend may provide educational resources and alerts to help users stay vigilant against phishing attempts, scams, and other security threats. User awareness is an essential component of overall account security.

It’s important for users to actively participate in maintaining the security of their Paytend accounts by following best practices, such as using unique passwords, enabling multi-factor authentication when available, and promptly reporting any suspicious activities to Paytend customer support.

Users should also regularly review and update their security settings, keep their mobile apps and devices up to date, and be cautious about sharing sensitive information to further enhance the security of their Paytend accounts.

Verified Paytend Account Supported Country

Paytend’s availability and supported countries may vary depending on regulatory approvals, partnerships, and business expansion strategies. Paytend aims to provide its digital banking and payment services to users globally, but the specific list of supported countries can change over time.

To determine whether Paytend supports accounts from your country or region, you can visit the Paytend website or download the Paytend mobile application from your device’s app store. During the account sign-up process, Paytend typically indicates whether its services are available in your location.

Additionally, you can contact Paytend’s customer support for assistance or inquiries regarding the availability of its services in specific countries or regions. They can provide you with the most up-to-date information and guidance regarding account eligibility and requirements based on your location.

It’s essential to verify the availability of Paytend’s services in your country or region before attempting to sign up for an account to ensure a seamless experience and access to the full range of features offered by Paytend.

Why People Looking For Verified Paytend Account

People may be interested in opening a buy Paytend account for several reasons:

- Convenience: Paytend offers a convenient way to manage finances entirely online or through mobile applications. Users can make payments, transfer money, and access account information anytime, anywhere, without the need to visit a physical bank branch.

- Digital Wallet: Paytend functions as a digital wallet, allowing users to store funds securely and manage their money digitally. This eliminates the need for carrying physical cash or visiting brick-and-mortar banks.

- Payment Solutions: With Paytend, users can make payments online, in-store, and through mobile devices using virtual or physical Paytend payment cards. This offers flexibility and convenience in conducting transactions.

- Budgeting Tools: Paytend may offer features to help users track their spending, set budgets, and manage their finances more effectively. These tools can help users achieve their financial goals and improve their financial habits.

- Security Measures: Paytend prioritizes security by implementing encryption, multi-factor authentication, and other advanced security measures to protect user accounts and transactions. This helps safeguard user funds and personal information from unauthorized access.

- Global Accessibility: Paytend may offer its services to users across different countries and regions, providing global accessibility to essential financial services. This allows individuals and businesses worldwide to access Paytend’s digital banking and payment solutions.

- Cost-Effectiveness: Paytend may offer competitive fee structures, transparent pricing, and cost-effective solutions for users, making it an attractive option for those seeking affordable financial services.

- Innovative Features: Paytend may incorporate innovative features and technologies into its services, such as biometric authentication, budgeting tools, and real-time transaction monitoring, enhancing the overall user experience and functionality.

Overall, people may be looking for Paytend accounts due to the platform’s convenience, security, digital wallet features, global accessibility, competitive offerings, and innovative solutions in the digital banking and payment space.

“Unlock Financial Freedom with Paytend: Your Complete Guide to Digital Banking”

In today’s fast-paced world, managing finances should be simple, secure, and accessible. Introducing Paytend – your gateway to seamless digital banking solutions designed to revolutionize the way you manage your money. With a Paytend account, you gain access to a suite of financial tools and features tailored to meet your needs, all at your fingertips. Let’s explore how Paytend can empower you to take control of your finances and achieve your goals with ease.

Embrace the Future of Banking with Paytend

1. Digital Wallet Convenience:

Say goodbye to the hassle of carrying cash and the limitations of traditional banking. With Paytend, you have a digital wallet that puts your finances in your hands, anytime, anywhere. Store funds securely, make payments effortlessly, and manage your money with unparalleled convenience.

2. Seamless Payment Solutions:

Experience the freedom of making payments online, in-store, or on-the-go with Paytend’s versatile payment solutions. Whether you prefer virtual cards for secure online transactions or physical cards for everyday purchases, Paytend has you covered.

3. Global Accessibility:

No matter where life takes you, Paytend is there to support you. With global accessibility, you can access your Paytend account from anywhere in the world, empowering you to manage your finances on your terms, 24/7.

4. Advanced Security Measures:

Your security is our top priority. Paytend employs state-of-the-art encryption, multi-factor authentication, and real-time fraud monitoring to safeguard your account and protect your funds against unauthorized access and fraudulent activity.

5. Budgeting Tools and Insights:

Take control of your finances with Paytend’s comprehensive budgeting tools and insights. Track your spending, set savings goals, and gain valuable insights into your financial habits to make informed decisions and achieve your financial objectives.

6. Transparent Pricing:

With Paytend, what you see is what you get. Say goodbye to hidden fees and unexpected charges. Paytend offers transparent pricing and competitive fee structures, ensuring that you always know where your money is going.

Join the Paytend Revolution Today

Join millions of users worldwide who have embraced Paytend as their trusted partner in financial empowerment. With Paytend, you’re not just opening an account – you’re unlocking a world of possibilities and taking the first step towards a brighter financial future. Sign up for your Paytend account now and experience the future of banking today.

Discover the power of Paytend and transform the way you manage your money. Welcome to the future of banking. Welcome to Paytend.

Summary Of Verified Paytend Accounts

A Paytend account offers users a modern and convenient digital banking experience, providing access to essential financial tools and services tailored to meet individual needs. Key highlights of a Paytend account include:

- Digital Wallet Convenience: Paytend serves as a digital wallet, enabling users to manage their finances, store funds securely, and make payments effortlessly, all from the convenience of their smartphones or computers.

- Seamless Payment Solutions: Users can enjoy versatile payment solutions with Paytend, including virtual and physical payment cards for online, in-store, and mobile transactions. Paytend’s payment options offer flexibility and convenience in conducting financial transactions.

- Global Accessibility: With Paytend, users can access their accounts and manage their finances from anywhere in the world, empowering them to stay connected and in control of their money, 24/7.

- Advanced Security Measures: Paytend prioritizes the security of user accounts and transactions, implementing state-of-the-art encryption, multi-factor authentication, and real-time fraud monitoring to safeguard against unauthorized access and fraudulent activity.

- Budgeting Tools and Insights: Paytend provides comprehensive budgeting tools and insights, allowing users to track spending, set savings goals, and gain valuable insights into their financial habits to make informed decisions and achieve financial objectives.

- Transparent Pricing: Paytend offers transparent pricing and competitive fee structures, ensuring that users know exactly where their money is going and providing peace of mind when managing their finances.

In summary, a Paytend account offers users a modern, secure, and flexible digital banking experience, empowering them to take control of their finances and achieve their financial goals with confidence and convenience.

Are you looking to buy paytend account?

We offer verified paytend for sale. You can buy paytend account from us.

In This Service, You’ll Get:

- Login Details

- Mail Access

Delivery Time

Usually, to deliver accounts for sale we take 3 to 5 hours and a maximum of up to 24 to 48 hrs. Also, it depends on stock availability. So make sure to note the delivery time frame.

Warranty/Replacement

We provide 24h replacement guarantee for accounts after delivery. So If the account gets closed or didn’t log in within 24 hours, Please contact Telegram.

The account won’t be replaced or refunded if you change your password or username or do any action prohibiting the platform is used.

We are not responsible for blocks, bans, etc after you start using the accounts, it’s your own responsibility.

Benefits From Us

If you want to for your business, then your first choice would be our company. We guarantee 100% of our services. High-quality services, Replacements guarantee, and old – new accounts. We accept payment methods like USDT, BTC, and LTC. If our deal is canceled or any problem occurs, we give a 100% money-back guarantee.

Reviews

There are no reviews yet.