Buy verified Paxum account:

Paxum is an online payment service provider that specializes in facilitating secure and efficient payments for businesses and individuals in various industries, including adult entertainment, affiliate marketing, e-commerce, and freelancing. Paxum offers a range of financial services designed to streamline transactions and provide flexibility in managing funds. Some key features and services of Paxum accounts include:

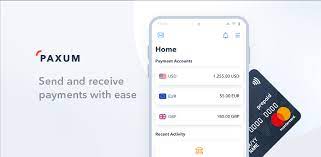

- Payment Solutions: Paxum allows users to send and receive payments globally, making it ideal for businesses and freelancers with international clients and partners.

- Currency Exchange: Users can exchange between different currencies within their Paxum accounts, providing flexibility in managing funds and reducing currency conversion fees.

- Digital Wallet: Paxum provides users with a digital wallet where they can securely store their funds and access them for payments, transfers, and withdrawals.

- Integration with Marketplaces: Paxum integrates with various online platforms, marketplaces, and payment gateways, allowing users to receive payments directly into their Paxum accounts.

- Card Services: Paxum offers prepaid Mastercard debit cards linked to users’ Paxum accounts, providing convenient access to funds for online and offline purchases, ATM withdrawals, and other transactions.

- Security Measures: Paxum prioritizes the security of user accounts and transactions, implementing advanced encryption, fraud detection, and compliance measures to protect user information and funds.

- Customer Support: Paxum provides customer support through various channels, including email, live chat, and phone support, assisting users with inquiries, issues, and account-related matters.

Overall, Paxum accounts serve as a reliable and efficient solution for businesses, freelancers, and individuals seeking convenient payment solutions, currency exchange services, and digital wallet functionality to streamline their financial operations and manage transactions effectively.

Buy Verified Paxum account:

To create a Paxum account, follow these steps:

- Visit the Paxum Website: Open your web browser and go to the official Paxum website. The URL is typically “www.paxum.com“.

- Sign Up for an Account: Look for the “Sign Up” or “Create an Account” option on the Paxum homepage and click on it to start the registration process.

- Provide Your Information: Fill out the registration form with the required information. You will typically need to provide details such as your name, email address, country of residence, and desired account type.

- Verify Your Email Address: After completing the registration form, Paxum will send a confirmation email to the email address you provided during registration. Check your email inbox and click on the confirmation link to verify your email address.

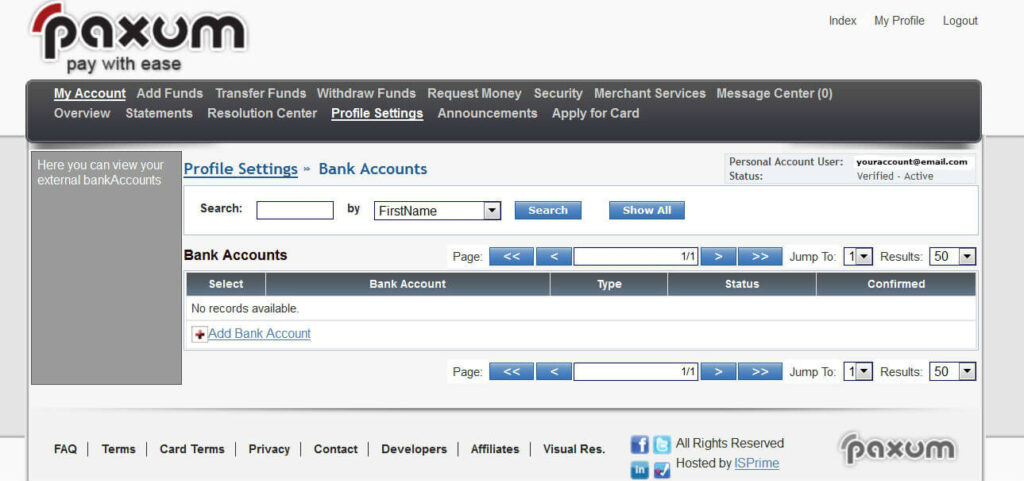

- Complete Account Verification (if required): Depending on your location and the type of account you are creating, Paxum may require you to complete additional verification steps to verify your identity and comply with regulatory requirements. This may include providing identification documents such as a passport or driver’s license.

- Set Up Security Measures: Once your account is verified, you can set up security measures such as two-factor authentication (2FA) to enhance the security of your Paxum account.

- Access Your Account: After completing the registration and verification process, you can log in to your Paxum account using the email address and password you provided during registration.

- Fund Your Account: To start using your Paxum account, you may need to fund it by adding funds from your bank account or another payment method accepted by Paxum.

- Explore Paxum Features: Once your account is funded and activated, you can explore the features and services offered by Paxum, such as sending and receiving payments, currency exchange, and accessing your digital wallet.

Remember to keep your Paxum account information secure and avoid sharing your login credentials with anyone to prevent unauthorized access to your account. Additionally, review Paxum’s terms of service and policies to understand your rights and responsibilities as a Paxum account holder.

Buy verified paxum accounts:

Here are some frequently asked questions (FAQs) about Paxum accounts:

-

What is Paxum?

- Paxum is an online payment service provider that offers secure and efficient payment solutions for businesses and individuals in various industries.

-

How do I create a Paxum account?

- To create a Paxum account, visit the official Paxum website, sign up for an account, provide your personal information, verify your email address, and complete any required verification steps.

-

Is it free to create a Paxum account?

- Yes, it is free to create a Paxum account. However, certain transactions and services offered by Paxum may be subject to fees.

-

What services does Paxum offer?

- Paxum offers a range of financial services, including online payments, money transfers, currency exchange, digital wallet functionality, and prepaid Mastercard debit cards.

-

Which currencies does Paxum support?

- Paxum supports various fiat currencies and may also support some cryptocurrencies, allowing users to transact in multiple currencies and digital assets.

-

Can I send money internationally with Paxum?

- Yes, Paxum allows users to send and receive money domestically and internationally, providing a convenient way to transfer funds to family, friends, or business associates worldwide.

-

How do I deposit funds into my Paxum account?

- Paxum supports various deposit methods, including bank transfers, credit/debit cards, and cryptocurrency deposits, depending on your location and account type.

-

Is Paxum safe and secure?

- Paxum prioritizes the security of user accounts and transactions by implementing encryption, two-factor authentication, and other security measures to protect user information and funds.

-

Can I use Paxum for online shopping and payments?

- Yes, Paxum can be used for online shopping and payments at merchants and websites that accept Paxum as a payment method.

-

How do I contact Paxum customer support?

- Paxum provides customer support through various channels, including email, live chat, and phone support. Users can reach out to Paxum’s customer support team for assistance with inquiries, issues, and account-related matters.

These are some common questions about Paxum accounts, but users may have additional inquiries depending on their specific needs and circumstances.

Pros and cons of Paxum Account:

Here are the pros and cons of having a Paxum account:

Pros:

- Global Payments: Paxum enables users to send and receive payments globally, making it convenient for businesses and individuals with international transactions.

- Currency Exchange: Paxum supports currency exchange between various fiat currencies, providing users with flexibility in managing their funds and reducing currency conversion fees.

- Digital Wallet: Paxum offers users a digital wallet where they can securely store their funds and access them for payments, transfers, and withdrawals.

- Prepaid Mastercard Debit Cards: Paxum provides users with prepaid Mastercard debit cards linked to their Paxum accounts, offering convenient access to funds for online and offline purchases, ATM withdrawals, and other transactions.

- Security Measures: Paxum prioritizes the security of user accounts and transactions, implementing encryption, two-factor authentication, and fraud detection to protect user information and funds.

- Integration with Online Platforms: Paxum integrates with various online platforms, marketplaces, and payment gateways, allowing users to receive payments directly into their Paxum accounts.

- Customer Support: Paxum offers customer support through various channels, including email, live chat, and phone support, assisting users with inquiries, issues, and account-related matters.

Cons:

- Fees: Paxum may charge fees for certain transactions and services, including currency exchange, withdrawals, and transfers, which can add up and impact the overall cost of using Paxum’s services.

- Verification Requirements: Some Paxum accounts may require verification, including providing identification documents such as a passport or driver’s license, which can be time-consuming and may delay account activation.

- Limited Acceptance: While Paxum integrates with various online platforms and merchants, its acceptance may be limited compared to other payment methods, especially in certain regions or industries.

- Currency Exchange Rates: Paxum applies exchange rates when converting currencies, and these rates may not always be the most competitive compared to other currency exchange services, potentially resulting in higher costs for users.

- Risk of Fraud and Scams: Like any online financial platform, Paxum users may be vulnerable to fraud, scams, and unauthorized transactions, especially if account security measures are not properly implemented or maintained.

Overall, Paxum accounts offer a range of features and services that cater to the needs of businesses and individuals requiring convenient payment solutions and financial management tools. However, users should carefully consider the fees, verification requirements, and security measures associated with Paxum accounts before choosing to use the platform.

Why verified paxum account for sale:

The security of a Paxum account is paramount to protect user information, funds, and transactions. Paxum employs various security measures to ensure the safety and integrity of user accounts. Here are some key security features and practices implemented by Paxum:

- Encryption: Paxum utilizes advanced encryption protocols to secure user data and communications. Encryption helps protect sensitive information, such as account credentials and financial details, from unauthorized access and interception by third parties.

- Two-Factor Authentication (2FA): Paxum offers two-factor authentication as an additional layer of security for user accounts. Users can enable 2FA to require a unique verification code in addition to their password when logging in, adding an extra barrier against unauthorized access.

- Fraud Detection: Paxum employs sophisticated algorithms and fraud detection systems to monitor user accounts and transactions for signs of suspicious activity. This proactive approach helps identify and prevent fraudulent behavior, such as unauthorized access, account takeovers, and fraudulent transactions.

- Account Verification: Paxum may require users to undergo account verification, especially for certain features or higher transaction limits. Account verification may involve providing additional documentation to confirm the user’s identity and enhance account security.

- Regular Audits and Compliance: Paxum conducts regular audits and complies with regulatory standards and industry best practices to ensure the security and integrity of its financial services. This includes implementing anti-money laundering (AML) measures, Know Your Customer (KYC) verification processes, and other regulatory controls.

- Secure Network Infrastructure: Paxum maintains a secure network infrastructure to protect user information and transactions from unauthorized access and cyber threats. This includes employing firewalls, intrusion detection systems, and other security measures to safeguard user data.

- Customer Education: Paxum provides users with educational resources and security tips to help them recognize and avoid common scams, phishing attacks, and fraudulent schemes. By educating users about potential security threats and best practices for online safety, Paxum empowers users to protect their accounts and personal information.

Overall, Paxum prioritizes the security of user accounts and transactions by implementing robust security measures, encryption protocols, and compliance standards. However, users should also take proactive steps to enhance their account security, such as enabling 2FA, using strong and unique passwords, and regularly monitoring their account activity for any signs of suspicious behavior.

Verified paxum account for sale with KYC

Paxum accounts are available to users in many countries around the world, making it accessible to a wide range of individuals and businesses. While Paxum does not explicitly list the specific countries where its services are available, it is known to have a global reach and supports users from various regions.

However, the availability of certain features and services may vary depending on the user’s country of residence and local regulations. Some countries may have restrictions or limitations on certain types of financial transactions or services, which could impact the availability of Paxum’s services in those regions.

Overall, Paxum aims to provide its services to users in as many countries as possible, but users should verify whether they can use Paxum’s services in their country and review any applicable terms and conditions before signing up for an account.

Why people looking to buy Paxum account:

People may seek a buy paxum account for several reasons:

- Global Payments: Paxum facilitates international payments, making it attractive to businesses and individuals who engage in cross-border transactions.

- Convenience: With Paxum, users can send and receive payments quickly and conveniently, eliminating the need for traditional banking processes and delays.

- Industry Specific: Paxum caters to specific industries such as adult entertainment, affiliate marketing, and freelancing, providing tailored services and solutions for individuals and businesses within these sectors.

- Currency Exchange: Paxum allows users to exchange currencies, offering flexibility for those who deal with multiple currencies in their transactions.

- Prepaid Mastercard: The option to obtain a Paxum prepaid Mastercard provides users with easy access to their funds for online and offline purchases, ATM withdrawals, and other transactions.

- Digital Wallet: Paxum offers users a digital wallet where they can securely store funds and manage their finances, providing a convenient and centralized platform for financial management.

- Security: Paxum emphasizes security measures such as encryption, two-factor authentication, and fraud detection, instilling confidence in users regarding the safety of their accounts and transactions.

- Integration with Online Platforms: Paxum integrates with various online platforms, making it easy for users to receive payments directly into their accounts from affiliate networks, marketplaces, and other platforms.

- Support Services: Paxum provides customer support through various channels, assisting users with inquiries, issues, and account-related matters, contributing to a positive user experience.

Overall, people may choose Paxum for its convenience, flexibility, industry-specific features, and security measures, making it a preferred option for individuals and businesses seeking efficient payment solutions in today’s digital economy.

Summary

A Paxum account offers users a versatile and convenient platform for managing global payments and financial transactions. Key features include:

- Global Payments: Paxum facilitates international transactions, allowing users to send and receive payments globally.

- Currency Exchange: Users can exchange currencies within their Paxum account, providing flexibility in managing funds across different currencies.

- Prepaid Mastercard: Paxum offers a prepaid Mastercard option linked to users’ accounts, enabling easy access to funds for online and offline purchases, ATM withdrawals, and other transactions.

- Digital Wallet: Paxum provides a digital wallet where users can securely store funds and manage their finances, offering a centralized platform for financial management.

- Security Measures: Paxum prioritizes account security with features like encryption, two-factor authentication, and fraud detection, ensuring the safety of user information and transactions.

- Integration with Online Platforms: Paxum integrates with various online platforms and marketplaces, allowing users to receive payments directly into their accounts.

- Customer Support: Paxum offers customer support through multiple channels, assisting users with inquiries, issues, and account-related matters.

In summary, a Paxum account empowers users with a comprehensive suite of tools and services to streamline global payments, manage finances efficiently, and navigate the digital economy with confidence.

Reviews

There are no reviews yet.