Buy Verified HSBC Bank Account

Hong Kong and Shanghai Banking Corporation is one of the world’s premier banks and financial service organizations. It offers bank accounts through which individuals, businesses and other entities can obtain various banking services.

Here are the main features and services provided by HSBC bank accounts:

Here are the main features and services provided by HSBC bank accounts:

Personal Banking Accounts: HSBC offers an assortment of personal banking accounts for consumers, including savings accounts, checking accounts, investment accounts and mobile banking services with ATM access around the globe. Some features may include online banking, mobile banking or ATM access worldwide.

Business Banking Accounts: HSBC provides banking solutions tailored to the specific needs of businesses, including business checking accounts, merchant services, loans and trade finance solutions.

International Banking: HSBC has long been known for its global reach, offering accounts and services tailored to meet the needs of expatriates, international students and businesses that engage in cross-border transactions.

Wealth Management Services from HSBC: These include private banking, investment advisory services, and wealth planning services for individuals with high net worth and families alike.

Credit and Debit Cards: HSBC provides account holders with credit and debit cards to facilitate convenient access to funds while offering rewards and benefits depending on the card type.

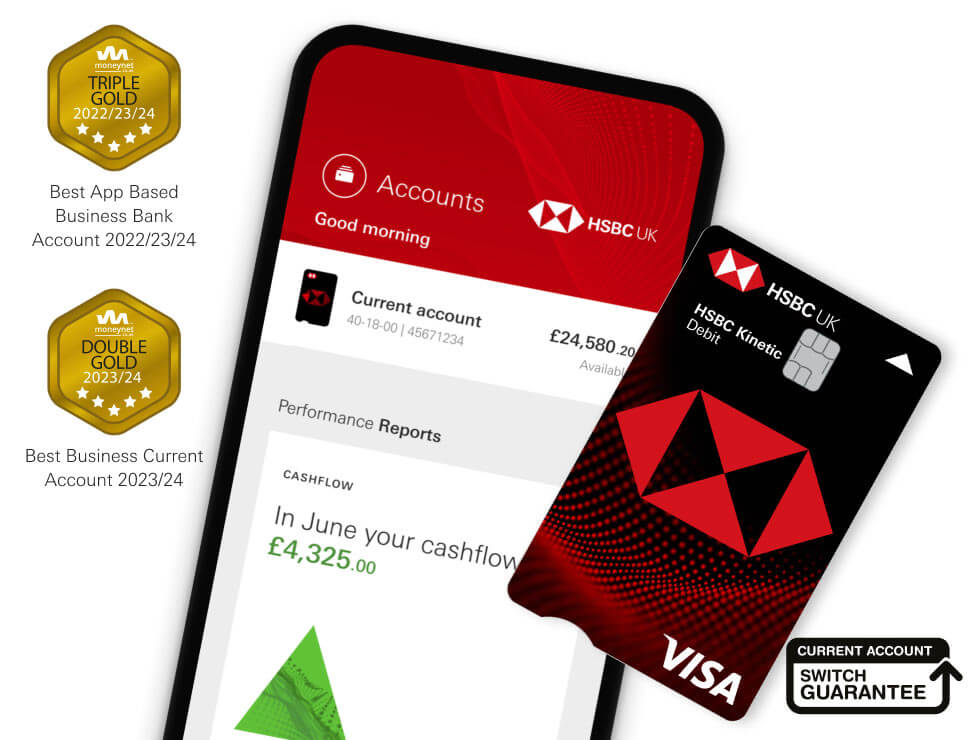

Online and Mobile Banking: HSBC provides its customers with online and mobile banking platforms, which allow them to manage their accounts, pay bills, transfer funds and perform other banking transactions remotely.

Customer Support: HSBC offers customer support through multiple channels, such as phone, email and in-branch assistance globally.

HSBC bank accounts vary based on the country or region where they’re opened in terms of features, benefits and eligibility criteria. Customers interested in opening an HSBC bank account should review all options available to them before making their decision, such as fees, interest rates and account features such as.

Buy Verified HSBC Bank Accounts

Buy Verified HSBC Bank Accounts

When opening an HSBC bank account, generally speaking, the following steps should be taken:

Investigate Account Options: Begin your investigation of the accounts offered by HSBC by doing some preliminary research into their various savings, checking and other banking products tailored specifically for different needs.

Select an Account That Best Fits: Once you understand all your available options, select an account type that best aligns with your financial goals and requirements.

Gather Required Documents: Gather the documents required to open an HSBC bank account. These usually include government-issued identification such as a passport or driver’s license, proof of address such as utility bills or rental agreements, as well as any additional requirements that might exist depending on local regulations and HSBC’s specific needs.

Visit or Apply Online: When opening an HSBC account, there are two methods available – visiting a branch directly or applying through their website, depending on which options are available in your region.

Fill Out an Application Form: In person, an HSBC representative will help guide you through the application form, while online applicants need to visit their website and fill out an application form directly.

Information Gathered: When applying, you will be required to provide personal details such as your full name, date of birth, contact information, employment and financial details.

Submit Documentation: Once complete, present all necessary documentation along with your application form – either by handing in originals at one of our branches or by uploading electronic copies online.

Identity Verification: HSBC may conduct an identity and address verification using the documents provided. This procedure meets regulatory requirements.

Initial Deposit: Depending on the account type you’re opening, an initial deposit may be necessary to fund your Account according to HSBC’s requirements. Be ready for this possibility!

Wait for Approval: Once HSBC has received your application and documents, they’ll need time to process your submission and approve your Account.

Once approved, you’ll receive your account details – such as account number and debit card (if applicable), plus any other pertinent information.

To Activate Account: Follow HSBC’s instructions in order to activate your Account as instructed, which could involve setting up online banking access and activating your debit card, among other steps.

Follow these steps to open an HSBC bank account and experience its many advantages. Be sure to review your terms and conditions, as well as HSBC’s banking services and features, before beginning.

FAQ Of Verified HSC Bank Accounts

FAQ Of Verified HSC Bank Accounts

Here are some frequently Asked Questions (FAQs) (FAQ) about buying an HSBC bank account:

HSBC offers various accounts, from savings accounts and checking accounts to investment accounts and specialty accounts designed to meet specific needs, like those for students or expatriates.

What requirements must I fulfill to open an HSBC bank account?

Requirements vary based on the account type and country regulations. Generally speaking, you will need identification documents, proof of address verification documents and additional documentation depending on which account type you select.

Are HSBC Bank accounts required to have minimum balance requirements?

Certain accounts from HSBC may have specific minimum balance requirements for opening and maintaining them; the details depend on which type of Account you select.

Are there fees associated with HSBC bank accounts?

HSBC may charge fees for various services, including monthly maintenance fees, overdraft charges, ATM fees, wire transfer costs and foreign transaction costs based on your account type and country regulations. These expenses vary based on account type.

Does HSBC Offer Online Banking Services?

Absolutely, HSBC provides customers with online banking services that enable them to manage their accounts, transfer funds between accounts, pay bills online, view statements and perform other banking functions conveniently from both computers and mobile devices.

Are my funds secure with HSBC?

HSBC is a well-recognized global bank that boasts an excellent track record for financial security and stability, and deposits held with them typically meet up to certain limits set forth by deposit insurance schemes in each country of operation.

Can I open an HSBC bank account online?

In most cases, you can begin the account opening process online through the HSBC website; however, to complete and provide identification documents as part of this process, you may have to visit one of its branches in person.

How long does it take to open an HSBC bank account?

The length of time needed to open an account with HSBC varies based on factors like account type, completeness of application form and local regulations in each country. Sometimes, you can open one right away; other times, it may take several days.

Do I qualify to open an HSBC bank account even if I am not a resident of this country?

HSBC may provide accounts explicitly tailored for non-residents, such as expatriate accounts and international student accounts, although their availability depends on your home country and HSBC’s policies.

How Can I Close My HSBC Bank Account Its?

In order to close an HSBC bank account, typically, you must visit one of their branches personally and request an account closure. Make sure any remaining funds or outstanding transactions or fees are withdrawn and settled prior to closing it down.

These are merely some frequently asked questions about HSBC bank accounts. For more specific answers or assistance, it would be advisable to reach out directly or visit their website.

Pros and Cons of Verified HSBC Bank Account

Below are the pros and cons associated with having an HSBC bank account:

Pros:

Global Presence: HSBC stands out among its competition due to its international reach, making banking convenient for customers with international needs or frequent travelers.

HSBC Offers an Extensive Range of Banking Products and Services: HSBC offers an expansive array of banking products and services, such as savings accounts, checking accounts, investment options, loans, credit cards and wealth management services – providing customers with financial solutions tailored to meet their individual needs.

Online and Mobile Banking: HSBC provides comprehensive online and mobile banking platforms that enable customers to manage their accounts, transfer funds between accounts, pay bills and view statements efficiently, as well as complete other banking tasks conveniently from computers or mobile devices.

Global Transfers: HSBC offers international money transfer services, making it easier for customers with family or business interests in multiple countries to send and receive funds more efficiently. This feature can be especially advantageous.

Financial Stability: HSBC is an established and financially sound bank with a longstanding history and strong banking credentials. Customers can have complete trust that the funds they hold with HSBC will remain safe.

Cons:

Fees and Charges: HSBC may charge various fees and charges related to banking services and transactions, including monthly maintenance fees, overdraft fees, ATM fees, wire transfer fees and foreign transaction fees compared with other banks. All these charges can add up over time and could prove more expensive in comparison with alternatives.

Minimum Balance Requirements: Certain HSBC accounts have minimum balance requirements that customers must meet in order to open and keep an account open and active. Failing to do so could incur additional fees or penalties that must be met or be considered an “outrage.”

Customer Service: While HSBC strives to offer excellent customer service, some customers may experience challenges such as long wait times, inconsistent quality service or difficulty reaching a representative during peak hours or in certain regions.

Limited Branch Network in Certain Areas: While HSBC maintains an international presence, its branch network may be limited in certain regions or countries outside major urban centers – this could pose challenges for customers who prefer in-person banking services.

International Customers may Experience Extra Complications When Banking with HSBC across Different Jurisdictions: International customers may face additional complexities regarding account opening, identification requirements, tax regulations and currency exchange rates when banking with us across different jurisdictions.

Overall, HSBC bank accounts offer many benefits and conveniences; however, customers should carefully consider any associated fees, requirements or service limitations prior to selecting them as their banking provider.

Why Looking to Buy Verified HSBC Bank Account

Why Looking to Buy Verified HSBC Bank Account

HSBC places great emphasis on security to protect its customers and maintain the integrity of its banking services. Below are a few measures HSBC employs in order to secure its bank accounts:

Encryption: HSBC employs stringent encryption protocols to protect customers’ sensitive data transmission between customer devices and HSBC’s servers, helping prevent unwarranted access to personal and financial information during online transactions and interactions with HSBC digital platforms.

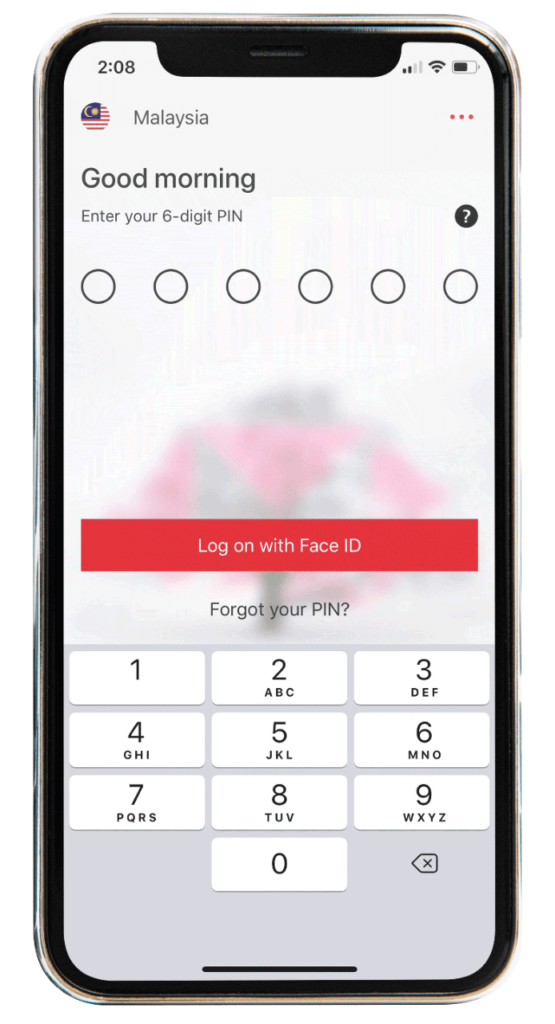

Two-Factor Authentication (2FA): HSBC utilizes two-factor authentication as an additional layer of protection for customer accounts. This usually involves asking customers to provide another form of verification, such as an OTP delivered to their mobile phone, in addition to providing their login credentials.

Biometric Authentication: In some regions, HSBC offers biometric authentication methods such as fingerprint or facial recognition technology to log onto mobile banking apps securely. These measures increase security by only allowing authorized users to gain entry.

Fraud Monitoring and Detection: HSBC utilizes advanced fraud detection systems that constantly monitor customer account activity for any unusual or suspicious transactions, and in cases of potential fraud are put into action to temporarily suspend transactions and notify customers in order to verify if these activities are legal.

Account Alerts: HSBC provides customers with the ability to set account alerts for various types of transactions and activities on their accounts, including account balance changes, large transactions or suspicious account activity – providing timely identification of security threats as soon as they arise.

Secure Online Banking Platform: HSBC’s online banking platform features several security measures such as log-in procedures, session timeouts and data encryption that protect customer information as well as transactions conducted on it.

Customer Education and Awareness: HSBC provides educational resources and guidance to help customers recognize and mitigate security risks such as phishing scams and identity theft. With these tools at their fingertips, customers can make more informed decisions and take preventative steps to safeguard their accounts and personal data.

Overall, HSBC implements an array of security measures to protect its bank accounts and maintain customer confidentiality, integrity and availability of customer data by prioritizing security and using advanced technologies to offer its customers a safe banking experience across both traditional and digital channels.

Verified HSBC Bank Account Supported Country

HSBC, one of the world’s largest international banks, operates in over 150 countries and territories worldwide. While availability varies based on location and local regulations, generally speaking, HSBC provides banking services in:

United Kingdom (UK), United States of America (US), Canada, Hong Kong, Singapore, Australia

Europe (comprised of numerous countries such as France, Germany, Spain, and Switzerland) mes, the Middle East (United Arab Emirates, Qatar and Saudi Arabia), Asia Pacific (Japan, South Korea, Taiwan etc.), and Latin America (Mexico, Brazil, Argentine etc.).

Here are just a few significant regions where HSBC operates and offers banking services. Additionally, their network of branches, subsidiaries, and partnerships may allow for their presence in even more countries and territories.

Individuals seeking information about HSBC’s presence and services in a particular country or region should visit its official website or reach out directly to inquire about banking options and account availability in their area.

Verified HSBC Bank Account For Sale

Verified HSBC Bank Account For Sale

People may open an HSBC bank account for various reasons, including:

Global Presence: HSBC bank Account is one of the world’s premier international banks, with branches located in many nations and territories around the globe. Individuals who travel frequently or conduct international business may find its global network and services helpful.

Diverse Banking Services: HSBC Bank Account offers a diverse array of banking products and services, such as savings accounts, checking accounts, investment services, credit cards, loans, mortgages and wealth management solutions tailored specifically to customer needs. Customers can take advantage of an assortment of financial products tailored to meet these demands.

Convenience and Accessibility: With its global network of branches and ATMs, as well as robust online and mobile banking platforms, HSBC Bank Account offers customers convenient access to their accounts and banking services at any time or place.

International Money Transfers and Currency Services: The HSBC bank Account offers international money transfers and currency exchange services that enable customers to send and receive funds globally while efficiently managing transactions across various currencies.

Strong Reputation and Stability: HSBC is widely known for its longstanding history, financial security, and adherence to regulatory standards, making customers feel at ease trusting HSBC with their banking needs.

Personalized Relationship Management: HSBC offers tailored banking services and relationship management to its customers through dedicated relationship managers and customer support teams. Customers can receive tailored advice and assistance according to their financial goals and needs.

Advanced Technology and Security: HSBC invests heavily in advanced security measures to protect customer data and transactions, such as biometric authentication, encryption and fraud detection systems to safeguard customer accounts and maintain their security and integrity.

Specialized Services for Expats and International Clients: HSBC offers tailored banking solutions tailored specifically for expatriates, international clients and high net-worth individuals, such as expat banking services, premier banking and global wealth management.

People choose HSBC bank accounts due to its global reach, comprehensive selection of banking services, convenient location options and security measures explicitly tailored to international travelers and clients.

“Unlock Global Banking Solutions with HSBC Bank Accounts”

Are you searching for a banking partner with global reach?

HSBC bank accounts offer access to an expansive suite of banking services tailored specifically to meet the financial needs of both domestic and international customers.

Why Select HSBC Bank Accounts as Your Primary Option To open or purchase bank accounts with HSBC is due to their global presence; with operations across numerous countries and territories worldwide, they provide exceptional access to international banking services that ensure you can stay financially connected no matter where life takes you.

Diverse Banking Solutions: HSBC offers an expansive selection of banking products and services, such as savings accounts, checking accounts, investment options, credit cards, loans, mortgages and wealth management solutions to suit every lifestyle and financial goal. Customize your experience to fit in seamlessly with your lifestyle and goals!

Convenience and Accessibility: Experience banking convenience like never before with HSBC’s user-friendly online and mobile banking platforms, giving you easy access to your accounts, transactions and finances from anytime, anywhere – with just a few clicks or taps of a finger!

International Transfers and Currency Services: Make global financial management simpler with HSBC’s international money transfer and currency exchange services, offering competitive rates with fast, secure transactions to meet all your global financial needs.

Trustworthy Reputation: HSBC is widely known for its longstanding and stellar reputation, financial strength, and commitment to regulatory compliance – giving you peace of mind knowing your finances are safe with one of the world’s premier banking institutions.

Personalized Customer Service: Take advantage of customized banking support and advice from HSBC’s team of expert relationship managers and customer service professionals, who are there to meet all your financial objectives and needs. Benefit from tailor-made solutions designed specifically for you!

Cutting-Edge Security Features: Protect your assets and personal information with cutting-edge security features offered by HSBC, such as encryption, biometric authentication and fraud detection systems. Enjoy peace of mind knowing your accounts are safeguarded from unauthorized access or any potential fraudulent activities.

Start banking seamlessly today by opening an HSBC bank account! Join millions of satisfied customers worldwide who trust HSBC to meet their financial aspirations.

Summary | HSBC bank accounts provide customers with a range of global financial solutions.

Here’s a run-down on some key HSBC bank accounts:

Global Presence: HSBC Bank Account operates in numerous countries and territories globally, giving customers access to international banking services through its extensive branch and ATM network.

Diverse Banking Products: HSBC bank Account provides an expansive array of banking products and services, such as savings accounts, checking accounts, investment options, credit cards, loans, mortgages and wealth management solutions.

Convenience and Access: With user-friendly online and mobile banking platforms, HSBC bank Account provides customers with easy access to their accounts and banking services anytime, anywhere.

International Banking Solutions: HSBC Bank Account offers international money transfers and currency exchange services that make international transactions simple and efficient for its customers. Customers can efficiently manage multiple currencies when transacting across borders.

Reputable Reputation: HSBC Bank Account has long been known for its trustworthy reputation, financial stability and compliance with regulatory standards – qualities that inspire trust among customers worldwide.

Personalized Customer Service: HSBC bank Account offers personalized banking support and advice through dedicated relationship managers and customer service teams, offering tailored solutions to meet the financial goals and needs of its customers.

Cutting-Edge Security Measures: At HSBC bank Account, security is of utmost importance for customer accounts and personal information, using cutting-edge security features such as encryption, biometric authentication and fraud detection systems to safeguard customer accounts and personal data.

Overall, HSBC bank accounts offer customers the flexibility, convenience, and security they require to manage their finances effectively both domestically and internationally. Boasting an expansive global presence with diverse banking products and tailored customer services that put customers first, the HSBC bank Account remains the go-to choice for individuals and businesses searching for reliable banking solutions worldwide.

Are you looking to buy hsbc bank account? We offer verified hsbc bank account for sale. You can buy hsbc bank account from us.

Are you looking to buy hsbc bank account? We offer verified hsbc bank account for sale. You can buy hsbc bank account from us.

In This Service, You’ll Get:

- Login Details

- Mail Access

Delivery Time

Usually, to deliver accounts for sale we take 3 to 5 hours and a maximum of up to 24 to 48 hrs. Also, it depends on stock availability. So make sure to note the delivery time frame.

Warranty/Replacement

We provide 24h replacement guarantee for accounts after delivery. So If the account gets closed or didn’t log in within 24 hours, Please contact Telegram.

The account won’t be replaced or refunded if you change your password or username or do any action prohibiting the platform is used.

We are not responsible for blocks, bans, etc after you start using the accounts, it’s your own responsibility.

Benefits From Us

If you want to for your business, then your first choice would be our company. We guarantee 100% of our services. High-quality services, Replacements guarantee, and old – new accounts. We accept payment methods like USDT, BTC, and LTC. If our deal is canceled or any problem occurs, we give a 100% money-back guarantee.

Barry –

I’m incredibly satisfied with the service provided by accountunltd.com. The HSBC verified account I received was exactly what I needed.

Leroy –

the transaction was smooth from start to finish. They deliver on their promises and provide excellent value for money. Highly recommended!

Alexander –

Impressive selection of verified accounts available at accountunltd.com. I found exactly what I needed for my project.