An Authorize.Net account is an account provided by Authorize.Net Account, a leading payment gateway service provider, to businesses that wish to accept payments online. It allows merchants to securely process credit card and electronic check transactions through their websites or other online platforms.

When a business signs up for an Authorize.Net account, they gain access to a range of services and features including:

- Payment Gateway: Authorize.Net Account provides the infrastructure to securely transmit payment information between the merchant’s website and the payment processor.

- Transaction Processing: Merchants can authorize, capture, and settle credit card and electronic check transactions in real-time or batch processing.

- Recurring Billing: Authorize.Net Account supports recurring billing options for subscription-based services or memberships.

- Fraud Prevention Tools: Merchants can implement various fraud prevention tools provided by Authorize.Net Account to help reduce the risk of fraudulent transactions.

- Customer Information Management: Authorize.Net Account offers features to securely store and manage customer payment information for future transactions.

- Reporting and Analytics: Merchants can access detailed reporting and analytics tools to track transaction activity, monitor sales performance, and reconcile payments.

Having an Authorize.Net account is essential for businesses that want to accept online payments securely and efficiently. It provides a convenient and reliable way to process transactions and manage payment-related tasks.

To create an Authorize.Net account, you typically follow these steps:

- Visit the Authorize.Net Account website: Go to the official website of Authorize.Net Account.

- Sign up for an account: Look for the option to sign up for an account or create a new account. This may be labeled as “Sign Up” or “Get Started”.

- Provide business information: You will need to provide information about your business, including your business name, address, contact information, tax ID number (or social security number if you’re a sole proprietorship), and other relevant details.

- Choose a pricing plan: Authorize.Net Account offers different pricing plans based on your business needs. Review the available plans and choose the one that best fits your requirements. Consider factors such as transaction fees, monthly fees, and additional features offered.

- Complete the application: Fill out the application form with accurate information. You may also need to agree to the terms of service and provide payment information for any setup fees or initial charges.

- Wait for approval: Once you submit your application, Authorize.Net Account will review it and verify your business information. This process may take a few days.

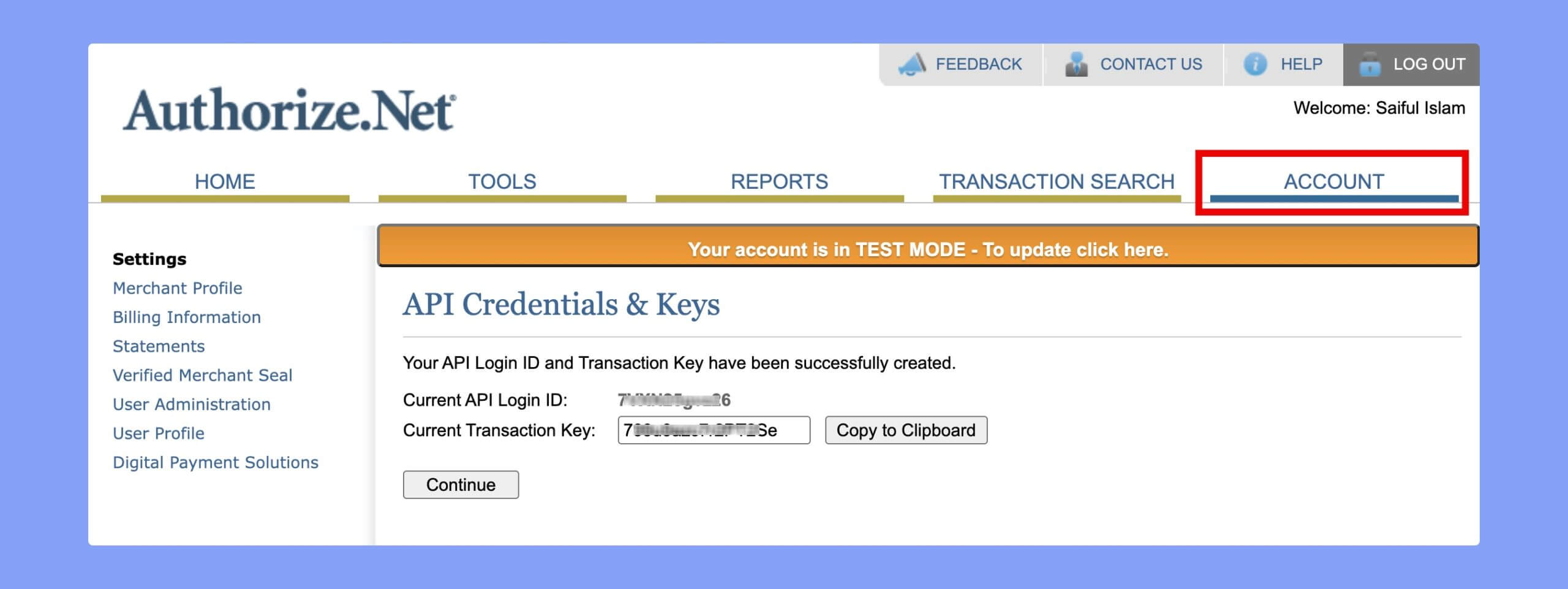

- Receive account credentials: Upon approval, you will receive account credentials, including a login ID and password, which you can use to access your Authorize.Net account.

- Integrate with your website or platform: Follow the instructions provided by Authorize.Net to integrate the payment gateway into your website or platform. This typically involves installing plugins, using APIs, or adding code snippets to your website’s checkout pages.

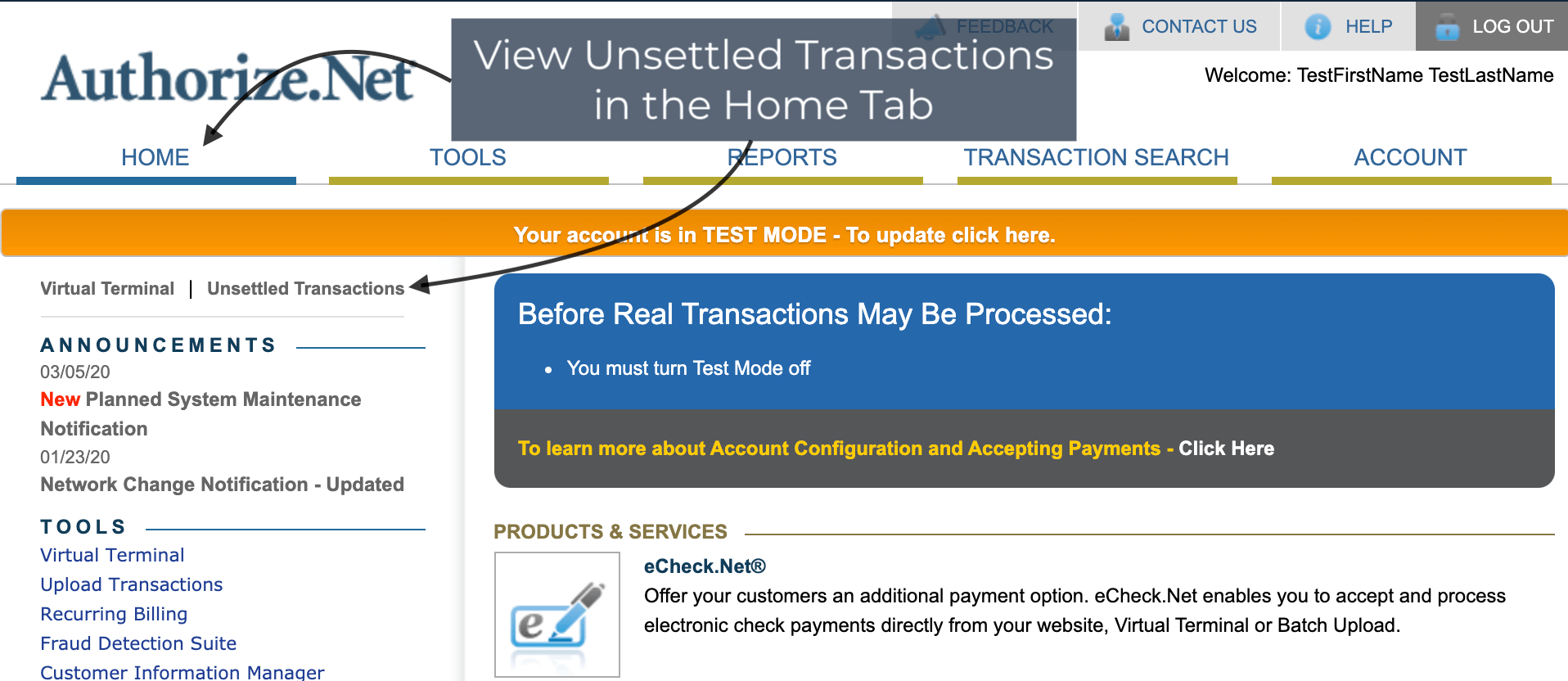

- Test transactions: Before going live, it’s important to conduct test transactions to ensure that everything is set up correctly and functioning as expected.

- Go live: Once you’ve completed testing and are satisfied with the setup, you can switch your account to live mode and start accepting real payments from customers.

Keep in mind that the specific steps may vary slightly depending on your location, business type, and other factors. Make sure to carefully review the terms and conditions of your Authorize.Net account and understand any associated fees or obligations.

Here are some frequently asked questions (FAQ) about Authorize.Net accounts:

-

What is Authorize.Net Account?

- Authorize.Net is a payment gateway service provider that enables businesses to accept credit card and electronic check payments securely through their websites or online platforms.

-

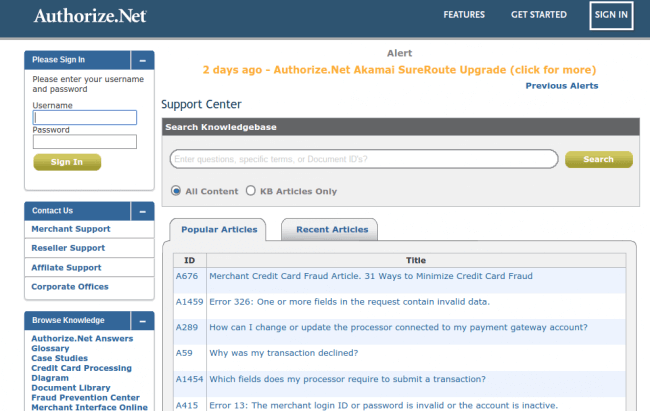

How do I sign up for an Authorize.Net account?

- To sign up for an Authorize.Net, visit their official website and follow the instructions for account creation. You will need to provide business information and choose a pricing plan that suits your needs.

-

What are the fees associated with an Authorize.Net account?

- Authorize.Net offers various pricing plans with different fee structures. Fees may include setup fees, monthly gateway fees, transaction fees, and additional service fees. It’s important to review the pricing details carefully before signing up.

-

What payment methods can I accept with Authorize.Net Account?

- Authorize.Net supports credit card payments (Visa, Mastercard, American Express, Discover, etc.) as well as electronic check payments (ACH).

-

Is there a contract or commitment required for an Authorize.Net account?

- Authorize.Net does not typically require long-term contracts or commitments. However, there may be terms of service that you agree to when signing up for an account.

-

How do I integrate Authorize.Net Account with my website or platform?

- Authorize.Net provides various integration options including API integration, hosted payment forms, plugins for popular e-commerce platforms, and SDKs for mobile apps. Instructions and documentation for integration are available on the Authorize.Net Account website.

-

Is Authorize.Net secure?

- Yes, Authorize.Net Account employs advanced security measures to protect sensitive payment information. This includes encryption, tokenization, fraud prevention tools, and compliance with industry security standards such as PCI DSS.

-

How do I access transaction reports and analytics with Authorize.Net?

- You can access transaction reports and analytics through your Authorize.Net dashboard. The dashboard provides detailed information about transaction history, sales volume, chargebacks, and more.

-

What customer support options are available with Authorize.Net?

- Authorize.Net offers customer support through various channels including phone, email, and online chat. They also provide documentation, FAQs, and tutorials to help merchants with common issues and questions.

-

Can I use Authorize.Net for recurring billing and subscriptions?

- Yes, Authorize.Net supports recurring billing functionality, allowing businesses to set up subscription plans and automatically bill customers on a recurring basis.

These are just a few of the common questions about Authorize.Net accounts. For more specific information or assistance, you can refer to the Authorize.Net website or contact their customer support team.

Authorize.Net offers several advantages and disadvantages for businesses looking to accept online payments:

Pros:

- Wide Acceptance: Authorize.Net is widely accepted by numerous online merchants and integrates with many popular e-commerce platforms and shopping carts, providing businesses with flexibility and compatibility.

- Security: Authorize.Net is known for its robust security features, including encryption, tokenization, and fraud prevention tools. It complies with industry standards such as PCI DSS (Payment Card Industry Data Security Standard), helping to protect sensitive payment information.

- Reliability: Authorize.Net has a reputation for reliability and uptime, ensuring that businesses can process transactions smoothly without significant interruptions.

- Flexibility: Authorize.Net offers various pricing plans and features, allowing businesses to choose the options that best suit their needs and budget. It supports multiple payment methods, including credit cards and electronic checks.

- Recurring Billing: Authorize.Net supports recurring billing functionality, making it easy for businesses to set up subscription-based services and automatically bill customers on a recurring basis.

Cons:

- Fees: While Authorize.Net offers flexibility in pricing plans, it does involve transaction fees, monthly gateway fees, and possibly other additional fees depending on the chosen plan and features. These fees can add up, particularly for smaller businesses or those with lower transaction volumes.

- Complexity of Setup: Integrating Authorize.Net with a website or platform can sometimes be complex, especially for businesses with limited technical expertise. While Authorize.Net provides documentation and support resources, setting up the payment gateway may require assistance from developers or IT professionals.

- Chargeback Fees: Authorize.Net may charge fees for chargebacks, which occur when customers dispute transactions. While chargebacks are a common risk in online payments, the associated fees can impact a business’s bottom line.

- Customer Support: While Authorize.Net offers customer support through various channels, some users have reported mixed experiences with response times and the effectiveness of support provided.

- Competition: While Authorize.Net is a well-established player in the payment gateway market, it faces competition from other providers offering similar services. Businesses may want to compare features, pricing, and customer reviews before selecting a payment gateway provider.

Overall, Authorize.Net can be a reliable and secure option for businesses looking to accept online payments, but it’s essential to consider both the advantages and disadvantages to make an informed decision based on specific business needs and priorities.

Authorize.Net Account prioritizes security to ensure the protection of sensitive payment information and maintain the trust of merchants and customers. Here are some key aspects of the security measures implemented by Authorize.Net Account:

- Encryption: Authorize.Net Account uses industry-standard SSL (Secure Sockets Layer) encryption to secure the transmission of data between the merchant’s website and the payment gateway. This encryption ensures that sensitive information such as credit card numbers and personal details are transmitted securely and cannot be intercepted by unauthorized parties.

- Tokenization: Authorize.Net Account employs tokenization, a process where sensitive cardholder data is replaced with a unique token. This token can be used for transaction processing without exposing the actual card data, reducing the risk associated with storing and transmitting sensitive information.

- PCI DSS Compliance: Authorize.Net Account is compliant with the Payment Card Industry Data Security Standard (PCI DSS), which is a set of security standards designed to ensure the secure handling of credit card information by merchants and service providers. Compliance with PCI DSS involves implementing various security measures and undergoing regular audits to assess and validate compliance.

- Fraud Prevention Tools: Authorize.Net Account provides merchants with a range of fraud prevention tools and features to help identify and mitigate fraudulent transactions. These tools include address verification (AVS), card code verification (CVV), velocity filters, IP geolocation, and customizable fraud detection rules.

- Account Security: Authorize.Net Account offers account-level security features such as two-factor authentication (2FA) to help prevent unauthorized access to merchant accounts. Two-factor authentication requires users to provide an additional form of verification, such as a one-time code sent to their mobile device, in addition to their login credentials.

- Security Audits and Monitoring: Authorize.Net Account conducts regular security audits and monitoring to detect and respond to potential security threats and vulnerabilities. This proactive approach helps ensure the ongoing integrity and security of the payment gateway infrastructure.

- Security Education and Awareness: Authorize.Net Account provides merchants with educational resources and best practices for maintaining security, such as guidelines for secure coding practices, data handling procedures, and fraud prevention strategies. By promoting security awareness among merchants, Authorize.Net Account helps mitigate the risk of security breaches and unauthorized access.

Overall, Authorize.Net Account is committed to maintaining the highest standards of security to protect the confidentiality, integrity, and availability of payment data processed through its platform. By implementing robust security measures and adhering to industry best practices, Authorize.Net Account helps safeguard the trust and confidence of merchants and customers in the payment processing ecosystem.

Authorize.Net Account supports merchants in several countries around the world, but the availability of its services may vary depending on the specific country and region.Authorize.Net Account primarily focuses on serving merchants based in the United States, Canada, the United Kingdom, Europe, and Australia. However, it’s essential to check with Authorize.Net Account directly or visit their website for the most up-to-date information regarding supported countries and regions.

Authorize.Net Account may have specific requirements or restrictions for merchants based on their location, such as legal and regulatory compliance, currency support, and payment processing capabilities. Additionally, the availability of certain features, pricing plans, and integration options may differ based on the country or region where the merchant operates.

If you’re considering using Authorize.Net Account as a payment gateway for your business and you’re located outside the primary supported countries, it’s advisable to reach out to Authorize.Net directly to inquire about their services and whether they can accommodate your specific needs and requirements.

People look for Authorize.Net accounts for several reasons, including:

- Online Payment Processing: Authorize.Net Account allows businesses to accept online payments securely through credit cards and electronic checks. Having an Authorize.Net account enables merchants to process transactions seamlessly on their websites or online platforms.

- Security: Authorize.Net Account is known for its robust security measures, including encryption, tokenization, and fraud prevention tools. Merchants prioritize security when choosing a payment gateway, and Authorize.Net’s reputation for security makes it a popular choice.

- Reliability: Authorize.Net Account has a reputation for reliability and uptime, ensuring that businesses can process transactions without interruptions. Merchants value a payment gateway that is dependable and can handle transaction volumes efficiently.

- Flexibility: Authorize.Net Account offers various pricing plans and features to accommodate businesses of different sizes and industries. Whether it’s a small business or a large enterprise, Authorize.Net Account provides options that suit different needs and budgets.

- Integration: Authorize.Net Account integrates with a wide range of e-commerce platforms, shopping carts, and business applications, making it easy for merchants to set up and manage their online payment processing. Integration with existing systems is crucial for businesses to streamline operations and improve efficiency.

- Recurring Billing: Authorize.Net Account supports recurring billing functionality, allowing businesses to set up subscription-based services and automatically bill customers on a recurring basis. This feature is valuable for businesses offering subscription boxes, membership services, or software as a service (SaaS) products.

- Customer Support: Authorize.Net Account offers customer support through various channels, including phone, email, and online chat. Prompt and responsive customer support is essential for merchants to resolve issues quickly and ensure smooth payment processing operations.

Overall, people look for Authorize.Net accounts because it provides a comprehensive solution for online payment processing, offering security, reliability, flexibility, and integration capabilities that meet the needs of businesses across various industries.

Secure and Seamless Online Payments with Authorize.Net Accounts

Are you looking for a reliable solution to accept online payments for your business? Look no further than Authorize.Net. With an Authorize.Net, you can securely process credit card and electronic check transactions, providing your customers with a seamless payment experience.

At Authorize.Net, security is our top priority. Our advanced encryption and tokenization technologies ensure that sensitive payment information is transmitted securely, protecting both you and your customers from potential data breaches.

- Reliability: Our robust infrastructure ensures that your transactions are processed smoothly and efficiently, with minimal downtime.

- Flexibility: Choose from a range of pricing plans and features to suit your business needs and budget. Whether you’re a small startup or a large enterprise, we have options that work for you.

- Integration: Seamlessly integrate Authorize.Net with your website or online platform using our easy-to-use APIs and plugins. We support integration with a wide range of e-commerce platforms, making setup a breeze.

- Recurring Billing: Set up subscription-based services and automatically bill your customers on a recurring basis. Our recurring billing functionality is perfect for subscription boxes, membership services, and more.

- Customer Support: Have questions or need assistance? Our dedicated customer support team is here to help, providing prompt and responsive support via phone, email, and online chat.

Don’t let payment processing be a headache for your business. With an Authorize.Net, you can focus on what you do best while we handle the rest. Sign up today and take your online payments to the next level with Authorize.Net Account.

Summary of Authorize.net Account:

Authorize.Net Account offers businesses a comprehensive solution for accepting online payments securely and efficiently. Here’s a summary of what an Authorize.Net provides:

- Payment Processing: Authorize.Net enables businesses to accept credit card and electronic check payments through their websites or online platforms.

- Security: Authorize.Net prioritizes security with encryption, tokenization, and fraud prevention tools to protect sensitive payment information.

- Reliability: Authorize.Net’s robust infrastructure ensures reliable transaction processing with minimal downtime, providing a seamless payment experience for customers.

- Flexibility: With various pricing plans and features, Authorize.Net caters to businesses of all sizes and industries, allowing them to choose options that suit their needs and budget.

- Integration: Authorize.Net seamlessly integrates with a wide range of e-commerce platforms and business applications, making setup and management easy for merchants.

- Recurring Billing: Businesses can set up subscription-based services and automatically bill customers on a recurring basis using Authorize.Net’s recurring billing functionality.

- Customer Support: Authorize.Net offers dedicated customer support via phone, email, and online chat, ensuring that merchants have access to assistance whenever they need it.

In summary, an Authorize.Net Account empowers businesses to streamline their online payment processing while prioritizing security, reliability, and flexibility.

John –

Trustable seller to buy authorize.net Verified accounts.

Smith –

I couldn’t believe my luck when I found this seller. They offered the best price for a verified authorize.net account, and the whole process was seamless. Their website is user-friendly, and their customer service team was responsive and helpful. A reliable source for all your account needs.

James –

Kudos to this legit seller for delivering exactly what they promised. I was searching for a verified authorize.net account and stumbled upon their website. The transaction was secure, and the account credentials were provided promptly. Highly trustworthy and professional.

Robert –

Prompt delivery and top-notch quality. accountunltd.com sets the standard for verified accounts.