Buy verified Squareup account:

Users of Square, Inc., a financial services and mobile payment company, create Squareup Accounts. Business management tools, payment processing, and point-of-sale solutions are all available through Square for small and medium-sized businesses.

Here’s a brief overview of Squareup Accounts:

Payment Processing: Squareup enables businesses to accept payments from customers through mobile, credit, and debit cards. Secure and convenient payments are possible with Square Accounts.

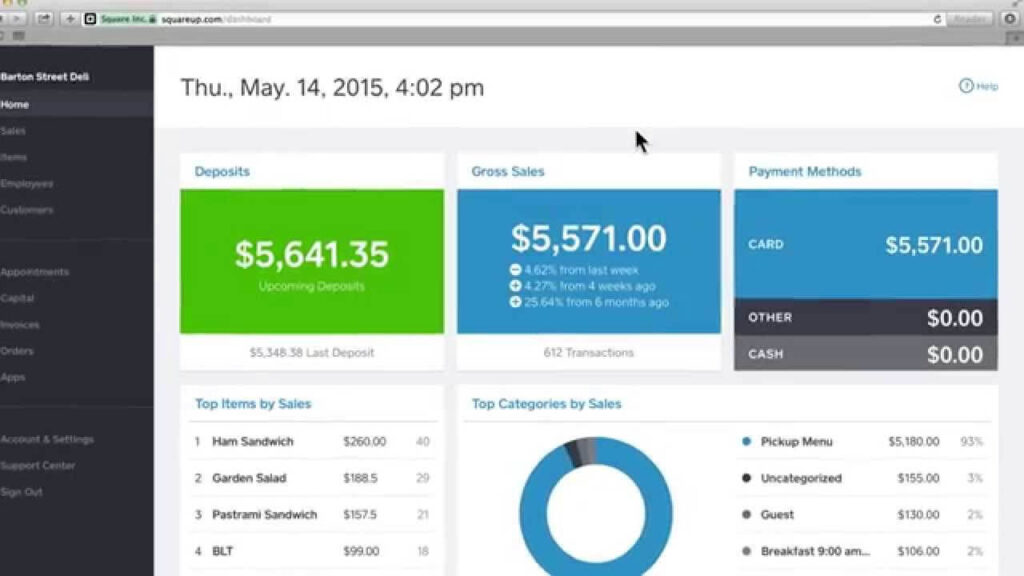

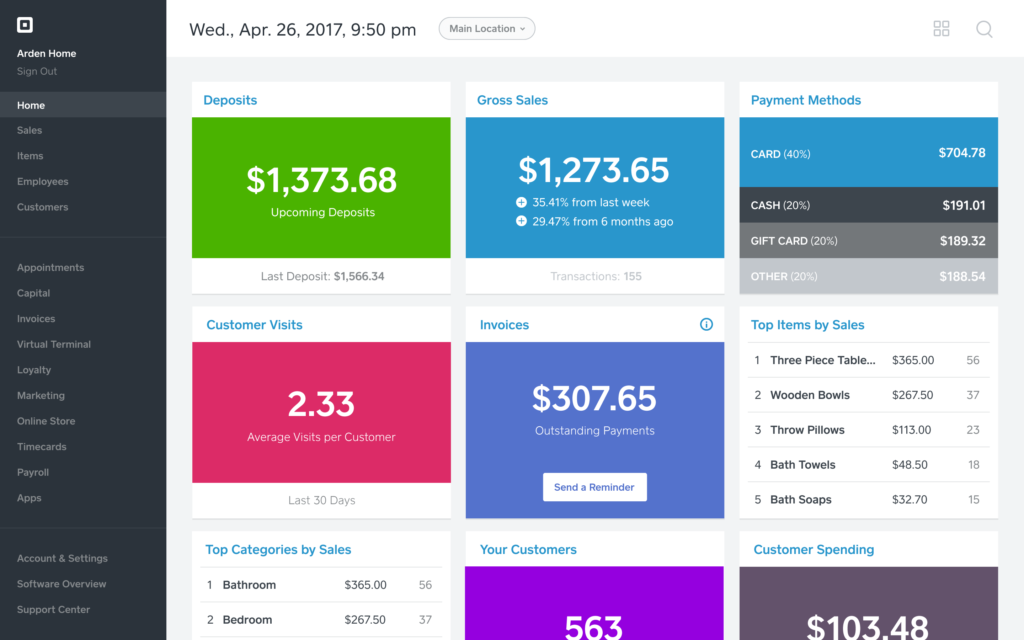

The Squareup Point-of-Sale system allows businesses to process transactions, manage inventory, and analyze sales data. Streamline your operations and improve efficiency with these tools.

Square allows businesses to create and manage online stores and sell products and services online. Customers can interact seamlessly across online and in-person transactions through a Square Account. This makes it easy to track payments, accept payments, and manage inventory. Square also provides businesses with valuable insights into their sales data, allowing them to make more informed decisions.

The Square app allows users to create and send invoices, track payments, and manage billing processes. A Square Account streamlines invoicing and billing workflows.

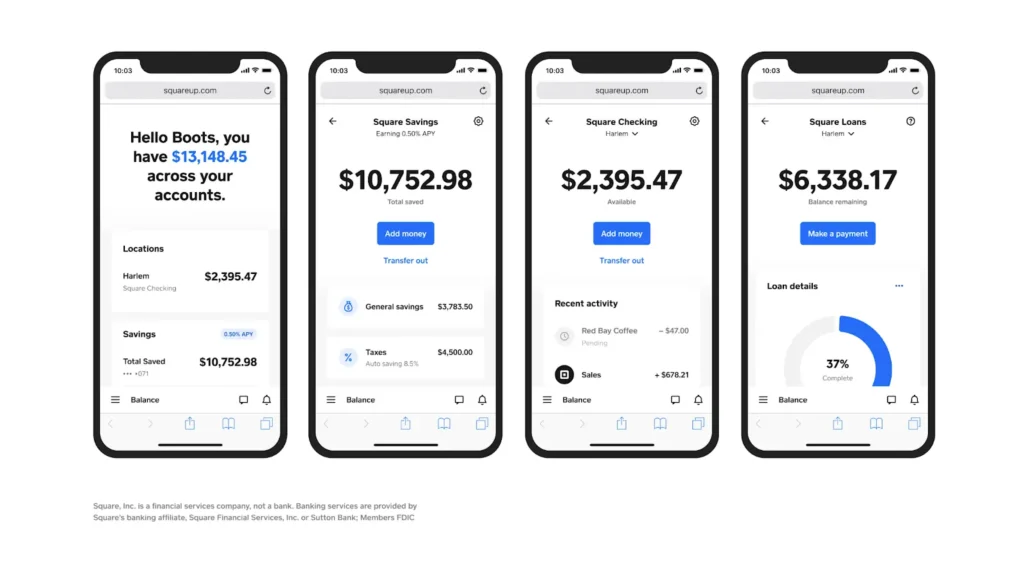

Business Financing: Square offers loans and credit lines to eligible businesses. In addition to helping companies manage cash flow, fund growth initiatives, and cover unexpected expenses, Square Accounts may offer access to financing solutions.

Analytics and Reporting: Square offers analytics and reporting tools that provide insights into sales performance, customer behavior, and other vital metrics. Users of a Square Account can access these tools to make informed business decisions and optimize their operations.

In summary, a Square Account is a business’s hub for accessing Square’s products and services, managing their financial transactions, and gathering valuable information. It provides businesses with the tools they need to succeed in today’s competitive marketplace.

How to create verified square account:

Square Accounts are easy to create and help individuals and businesses get started quickly. Creating a Square Account is simple:Square Website: Go to squareup.com in your browser. Create an account by clicking the “Sign Up” or “Get Started” button on the homepage.Enter your email address here.For account communication and verification, make sure to use an email address you have access to.Choose a Secure Password: Choose a good and secure password.Use a password that includes letters, numbers, and special characters as specified by Square.Square will ask for your business name, address, industry, and type of products and services you offer.Personal accounts require personal information.Email Verification: Check your email inbox for a Square verification email.The email will contain a verification link that you must click to verify your email address.Verify your identity and link a bank account for deposits when setting up your Square Account.Your business or personal identity may require additional information.The Square Point of Sale (POS) app is available in the App Store (for iOS devices) or Google Play Store (for Android devices).Square Account credentials are required to sign in.With a Square Account, you can accept payments, manage your business finances, and access additional features like invoicing and online store setup. Keep in mind that the specific steps to create a Square Account may vary slightly depending on your location, the type of account you’re creating (business or personal), and any additional requirements or verification processes imposed by Square. Make sure to carefully follow the instructions provided during the account creation process to ensure a smooth setup experience.

Buy verified squareUP accounts:

Frequently Asked Questions (FAQs) about Square Accounts may cover various aspects of the account creation process, account management, security measures, and services offered by Square. Here are some common questions that might be included in a Square Account.

What is a Square Account?

Provide an overview of what a Square Account is and the services it offers to businesses and individuals.

How do I create a Square Account?

Explain the steps to create a Square Account, including providing basic information, verifying identity, and linking a bank account.

What types of businesses can use Square?

Clarify the types of businesses and industries that can benefit from using Square’s services, including retail, food and beverage, professional services, and more.

Is there a fee for signing up for a Squareup Account?

Address any fees associated with creating and maintaining a Squareup Account, including account setup fees, transaction fees, and subscription fees for additional services.

What payment methods does Square accept?

Provide information about the types of payment methods that Square supports, including credit and debit cards, mobile payments, contactless payments, and online payments.

How secure is my Squareup Account?

Explain the security measures and protocols in place to protect Squareup Accounts and transactions, including encryption, fraud detection, and account authentication.

Can I use Square for online payments?

Discuss Square’s online payment processing capabilities, including setting up an online store, accepting payments on websites and mobile apps, and integrating with e-commerce platforms.

How do I access customer support for my Squareup Account?

Provide information about how users can contact Square’s customer support team for assistance with account-related inquiries, technical issues, and billing questions.

What reporting and analytics tools are available with Square?

Describe the reporting and analytics features that Square offers to help businesses track sales, monitor inventory, analyze customer trends, and make informed decisions.

Can I accept international payments with Square?

Explain Square’s international payment capabilities, including accepting payments in different currencies and conducting business with customers outside the United States.

Does Square offer business financing options?

Discuss Square’s business financing services, including loans and lines of credit, and explain the application process and eligibility criteria.

Why verified squareUP account to buy:

A Squareup Account offers numerous benefits and considerations for businesses and individuals looking to streamline their payment processing and financial management. Here’s a breakdown of the pros and cons associated with a Squareup Account:

Pros:

- Easy Setup: Creating a Squareup Account is quick and straightforward, requiring minimal documentation and technical knowledge. Businesses can start accepting payments almost immediately after sign-up.

- Versatile Payment Options: Square supports various payment methods, including credit and debit cards, mobile payments like Apple Pay and Google Pay, and contactless payments, providing flexibility for both businesses and customers.

- No Monthly Fees: Square typically does not charge monthly fees for maintaining an account. Businesses only pay fees on a per-transaction basis, making it cost-effective for companies with fluctuating sales volumes.

- Accessible Tools and Features: Square offers a suite of tools and features to help businesses manage their finances, including point-of-sale solutions, invoicing, online store integration, and analytics, all accessible through a single platform.

- Integration with Third-Party Software: Square integrates seamlessly with various third-party software and services, including accounting software like QuickBooks and inventory management systems, enabling businesses to streamline their operations.

- Security Features: Square employs robust security measures to protect transactions and customer data, including encryption, tokenization, and fraud detection systems, providing peace of mind for businesses and customers alike.

- Business Financing Options: Square offers business financing solutions, such as loans and lines of credit, to eligible businesses, helping them manage cash flow, invest in growth opportunities, and navigate financial challenges.

Cons:

- Transaction Fees: While there are no monthly fees, Square charges transaction fees on each payment processed through its platform. Depending on the business’s sales volume and transaction size, these fees can add up and impact profitability.

- Funds Holding and Reserve: Square may hold funds from transactions for a certain period or place reserves on accounts to mitigate the risk of chargebacks and fraud, which can affect cash flow for businesses, especially smaller ones.

- Limited Customer Support: Some users have reported challenges with accessing timely and responsive customer support from Square, particularly during peak periods or for more complex issues, which can hinder problem resolution and support needs.

- Hardware Costs: While Square offers free card readers for basic payment processing, businesses may incur costs for purchasing additional hardware, such as POS terminals and accessories, which can be a significant investment for some companies.

- Limited International Features: Square’s international features and capabilities are more limited compared to some other payment processors, which may pose challenges for businesses operating in multiple countries or catering to global customers.

- Account Stability Risks: Some businesses have experienced account stability issues with Square, including sudden account terminations or holds, which can disrupt operations and negatively impact revenue streams if not resolved promptly.

- Integration Complexity: While Square integrates with many third-party software and services, setting up and managing integrations can be complex and time-consuming, requiring technical expertise and ongoing maintenance.

Security of verified squareUP account for sale:

The security of a Squareup Account is a top priority for Square, Inc., the financial services and mobile payment company. Square employs a range of security measures to protect account information, transactions, and customer data. Here are some critical aspects of the security measures implemented by Square:

- Encryption: Square uses industry-standard encryption protocols to secure data transmission between users’ devices and Square’s servers.

- Tokenization: Square employs tokenization to safeguard payment information. Instead of storing actual credit card numbers or sensitive data, Square generates unique tokens that represent the payment information.

- Fraud Detection Systems: Square utilizes sophisticated fraud detection systems to monitor transactions in real time and identify potentially fraudulent activities. These systems analyze various factors, such as transaction patterns, geographic locations, and cardholder behavior, to detect and prevent fraudulent transactions.

- PCI Compliance: Square is compliant with the Payment Card Industry Data Security Standard (PCI DSS).

- Secure Access Controls: Square implements secure access controls to limit access to sensitive account information and features. Users are required to authenticate their identities through secure login methods, such as passwords and multi-factor authentication, to access their Squareup Accounts.

- Regular Security Audits: Square conducts regular security audits and assessments to identify vulnerabilities, assess risks, and ensure compliance with industry standards and best practices. These audits help maintain the integrity and security of Square’s systems and infrastructure.

- Education and Awareness: Square educates users about best practices for security and provides resources to help them protect their accounts and sensitive information.

- Dedicated Security Team: Square has a dedicated team of security professionals who continuously monitor and respond to security threats and incidents. This team works proactively to enhance security measures and address emerging threats to protect Squareup Accounts and customer data.

SquareUP Account Supported country:

Squareup Account, Inc. primarily operates in several countries, including the United States, Canada, Australia, Japan, and the United Kingdom. However, the availability of specific Square services and features may vary by country.

Square’s availability in other countries may depend on factors such as regulatory requirements, local banking infrastructure, and market demand. Square may expand its services to additional countries over time as it navigates regulatory challenges and identifies opportunities for growth.

Why people are looking to buy verified squareUP accounts?

People may seek out Squareup Accounts for various reasons, depending on their specific needs and circumstances. Here are several common motivations behind individuals and businesses looking to use Squareup Accounts:

- Convenient Payment Processing: Squareup Accounts offer businesses a convenient way to accept payments from customers through various channels, including in-person transactions, online payments, invoices, and mobile payments. The simplicity and ease of use make Square an attractive option for businesses seeking efficient payment processing solutions.

- Accessibility and Flexibility: Squareup Accounts provides businesses with flexible payment options and accessibility, allowing them to accept payments anytime, anywhere. With Square’s mobile point-of-sale (mPOS) solutions and online payment capabilities, businesses can expand their reach and serve customers in diverse environments.

- Cost-Effective Solutions: Square’s pricing structure, which typically includes transparent and competitive transaction fees without monthly subscription fees, can be appealing to small and medium-sized businesses with variable sales volumes. The absence of long-term contracts and hidden fees makes Squareup Accounts a cost-effective option for many companies.

- Streamlined Business Operations: Squareup Accounts offers integrated business management tools that help streamline various aspects of operations, including inventory management, customer relationship management (CRM), invoicing, and reporting. Businesses can leverage these features to improve efficiency, reduce administrative burdens, and focus on growth initiatives.

- Innovative Technology and Features: Square continually innovates and introduces new features and services that address evolving business needs and consumer preferences. From contactless payments and digital gift cards to appointment scheduling and payroll management, Squareup Accounts offers a wide range of capabilities to enhance the customer experience and drive business growth.

- Trust and Reliability: Square has established itself as a trusted and reliable provider of payment processing and financial services, serving millions of businesses worldwide. The company’s commitment to security, transparency, and customer support instills confidence among users and reinforces its reputation as a leading payment platform.

Why verified squareUP account for sale?

The security of a Squareup Account is a top priority for Square, Inc., the financial services and mobile payment company. Square employs a range of security measures to protect account information, transactions, and customer data. Here are some critical aspects of the security measures implemented by Square:

- Encryption: Square uses industry-standard encryption protocols to secure data transmission between users’ devices and Square’s servers.

- Tokenization: Square employs tokenization to safeguard payment information. Instead of storing actual credit card numbers or sensitive data, Square generates unique tokens that represent the payment information.

- Fraud Detection Systems: Square utilizes sophisticated fraud detection systems to monitor transactions in real time and identify potentially fraudulent activities. These systems analyze various factors, such as transaction patterns, geographic locations, and cardholder behavior, to detect and prevent fraudulent transactions.

- PCI Compliance: Square is compliant with the Payment Card Industry Data Security Standard (PCI DSS).

- Secure Access Controls: Square implements secure access controls to limit access to sensitive account information and features. Users are required to authenticate their identities through secure login methods, such as passwords and multi-factor authentication, to access their Squareup Accounts.

- Regular Security Audits: Square conducts regular security audits and assessments to identify vulnerabilities, assess risks, and ensure compliance with industry standards and best practices. These audits help maintain the integrity and security of Square’s systems and infrastructure.

- Education and Awareness: Squareup educates users about best practices for security and provides resources to help them protect their accounts and sensitive information.

- Dedicated Security Team: Square has a dedicated team of security professionals who continuously monitor and respond to security threats and incidents. This team works proactively to enhance security measures and address emerging threats to protect Squareup Accounts and customer data.

By implementing these security measures and adhering to industry standards, Square aims to provide a secure and trustworthy platform for businesses and individuals to manage their financial transactions and sensitive information. However, users also play a crucial role in maintaining account security by following best practices and remaining vigilant against potential security threats.

SquareUP Account Supported country:

Squareup Account, Inc. primarily operates in several countries, including the United States, Canada, Australia, Japan, and the United Kingdom. However, the availability of specific Square services and features may vary by country.

Square’s availability in other countries may depend on factors such as regulatory requirements, local banking infrastructure, and market demand. Square may expand its services to additional countries over time as it navigates regulatory challenges and identifies opportunities for growth.

Why people looking to buy verified squareUP accounts:

People may seek out Squareup Accounts for various reasons, depending on their specific needs and circumstances. Here are several common motivations behind individuals and businesses looking to use Squareup Accounts:

- Convenient Payment Processing: Squareup Accounts offer businesses a convenient way to accept payments from customers through various channels, including in-person transactions, online payments, invoices, and mobile payments. The simplicity and ease of use make Square an attractive option for businesses seeking efficient payment processing solutions.

- Accessibility and Flexibility: Squareup Accounts provides businesses with flexible payment options and accessibility, allowing them to accept payments anytime, anywhere. With Square’s mobile point-of-sale (mPOS) solutions and online payment capabilities, businesses can expand their reach and serve customers in diverse environments.

- Cost-Effective Solutions: Square’s pricing structure, which typically includes transparent and competitive transaction fees without monthly subscription fees, can be appealing to small and medium-sized businesses with variable sales volumes. The absence of long-term contracts and hidden fees makes Squareup Accounts a cost-effective option for many companies.

- Streamlined Business Operations: Squareup Accounts offers integrated business management tools that help streamline various aspects of operations, including inventory management, customer relationship management (CRM), invoicing, and reporting. Businesses can leverage these features to improve efficiency, reduce administrative burdens, and focus on growth initiatives.

- Innovative Technology and Features: Square continually innovates and introduces new features and services that address evolving business needs and consumer preferences. From contactless payments and digital gift cards to appointment scheduling and payroll management, Squareup Accounts offers a wide range of capabilities to enhance the customer experience and drive business growth.

- Trust and Reliability: Square has established itself as a trusted and reliable provider of payment processing and financial services, serving millions of businesses worldwide. The company’s commitment to security, transparency, and customer support instills confidence among users and reinforces its reputation as a leading payment platform.

Why Choose Squareup Account to Buy?

- Easy Setup: With a Squareup Account, getting started is a breeze. Sign up in minutes and start accepting payments right away; no complicated setup is required.

- Versatile Payment Options: From credit and debit cards to contactless payments and mobile wallets, Squareup Account supports a wide range of payment methods, ensuring you never miss a sale.

- Transparent Pricing: Say goodbye to hidden fees and long-term contracts. With Squareup Account, you only pay for what you use, with no surprises or monthly commitments.

- Powerful Tools: Manage your business with confidence using Square’s suite of tools, including point-of-sale solutions, inventory management, invoicing, and analytics.

- Security First: Rest easy knowing that your transactions and customer data are protected by industry-leading security measures, including encryption, tokenization, and fraud detection.

Summary of SquareUP Account:

A SquareUP Account is a versatile financial platform offered by Square, Inc. It provides businesses of all sizes with streamlined payment processing solutions and essential tools to manage their operations effectively. With Squareup Account, users can accept a variety of payment methods, including credit cards, debit cards, mobile payments, and contactless transactions. The platform offers easy setup, transparent pricing, and powerful tools such as point-of-sale solutions, inventory management, invoicing, and analytics. Security is prioritized with industry-leading measures like encryption, tokenization, and fraud detection. Squareup Account empowers businesses to thrive in today’s dynamic marketplace by providing simple, secure, and reliable payment solutions.

Reviews

There are no reviews yet.