Buy verified e-toro Account:

An eToro account refers to the user account created on the eToro platform, which is a social trading and multi-asset brokerage platform. Opening an eToro account allows users to access various financial instruments, including stocks, cryptocurrencies, commodities, forex, indices, and more, for trading and investment purposes.

Here are key aspects of an eToro account:

- Registration: To create an eToro account, users need to register on the eToro website or mobile app. The registration process typically involves providing personal information such as name, email address, and country of residence.

- Verification: After registering, users may need to complete a verification process to comply with regulatory requirements. This verification process may involve providing additional personal information, verifying identity documents, and confirming residency.

- Funding: Once the account is verified, users can fund their eToro accounts using various payment methods, including bank transfers, credit/debit cards, and online payment processors.

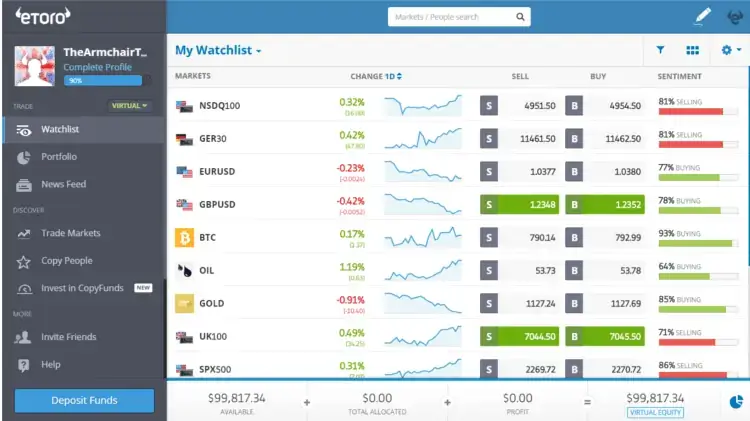

- Access to Trading: With a funded eToro account, users gain access to a wide range of financial instruments available on the platform. They can explore different markets, conduct market analysis, and execute trades based on their investment preferences and strategies.

- Social Trading Features: eToro offers social trading features that allow users to interact with other traders, follow their trading activities, and even automatically copy their trades. This feature enables novice traders to learn from experienced investors and potentially replicate their success.

- Portfolio Management: Users can manage their investment portfolios directly from their eToro accounts. They can monitor the performance of their investments, track market trends, and adjust their portfolios as needed to optimize their investment strategies.

- Regulatory Compliance: eToro is regulated by top-tier financial authorities in multiple jurisdictions, ensuring compliance with strict regulatory standards. This regulatory oversight helps protect user funds and ensures the integrity and transparency of the trading platform.

Overall, an eToro account provides users with access to a comprehensive trading and investment platform, offering a wide range of financial instruments, social trading features, portfolio management tools, and regulatory protection. It serves as the gateway for users to participate in the global financial markets and pursue their investment goals.

How to create buy verified e-toro account:

To create an eToro account, follow these steps:

- Visit the eToro Website: Open your web browser and navigate to the eToro website.

- Click on “Join Now”: On the eToro homepage, locate the “Join Now” or “Sign Up” button and click on it to begin the registration process.

- Provide Personal Information: Fill out the registration form with your personal information, including your full name, email address, and a password for your eToro account.

- Verify Email Address: After completing the registration form, eToro will send a verification email to the email address you provided. Check your email inbox for the verification email and click on the verification link to verify your email address.

- Complete Profile: Once your email address is verified, you will be prompted to complete your profile by providing additional information such as your country of residence, date of birth, and contact details.

- Verify Identity (KYC): As part of the verification process, eToro may require you to verify your identity to comply with regulatory requirements. This typically involves uploading a copy of your government-issued ID (e.g., passport or driver’s license) and proof of address (e.g., utility bill or bank statement).

- Agree to Terms and Conditions: Review eToro’s terms of service and privacy policy, and agree to the terms and conditions before proceeding with account creation.

- Choose Account Type: Select the type of account you wish to open (e.g., individual, corporate) and proceed to fund your account.

- Fund Your Account: Once your eToro account is created and verified, you can fund your account using various payment methods, including bank transfers, credit/debit cards, and online payment processors.

- Start Trading: With your eToro account funded, you can explore the platform’s features, access a wide range of financial instruments, and start trading or investing based on your preferences and investment goals.

It’s important to note that eToro may have specific requirements and procedures for account creation and verification, and these steps may vary depending on your jurisdiction and regulatory requirements. Make sure to follow the instructions provided by eToro during the account creation process and comply with any additional verification requests to ensure smooth account activation.

Faq of buy verified e-toro accounts:

Here are some frequently asked questions (FAQs) about eToro accounts:

-

What is eToro?

- eToro is a social trading and multi-asset brokerage platform that allows users to trade various financial instruments, including stocks, cryptocurrencies, commodities, forex, and indices.

-

How do I create an eToro account?

- To create an eToro account, visit the eToro website, click on the “Join Now” or “Sign Up” button, fill out the registration form, verify your email address, complete your profile, and verify your identity (KYC) if required.

-

What documents do I need to verify my identity (KYC)?

- To verify your identity on eToro, you may need to provide a government-issued ID (e.g., passport, driver’s license) and proof of address (e.g., utility bill, bank statement) as part of the KYC (Know Your Customer) process.

-

Is eToro regulated?

- Yes, eToro is regulated by top-tier financial authorities in multiple jurisdictions, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

-

What financial instruments can I trade on eToro?

- eToro offers access to a wide range of financial instruments, including stocks, cryptocurrencies, commodities (e.g., gold, oil), forex pairs, and indices.

-

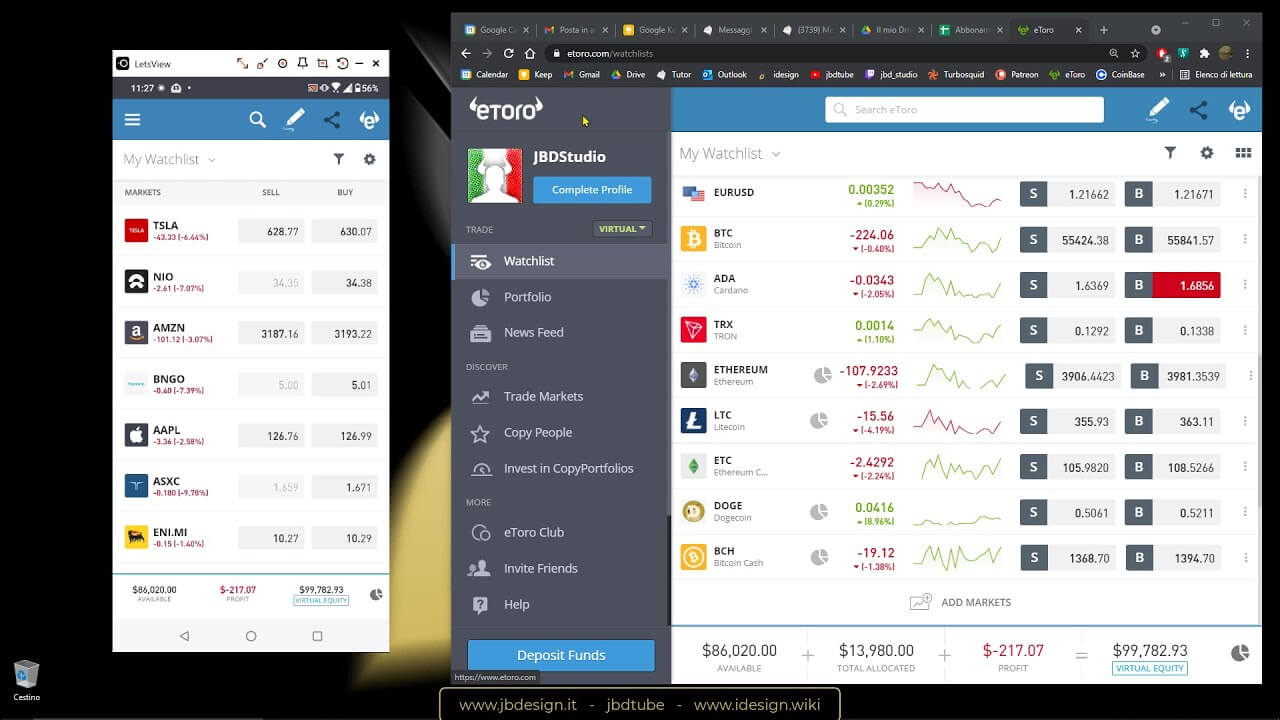

Does eToro offer demo accounts?

- Yes, eToro offers demo accounts that allow users to practice trading with virtual funds before risking real money. Demo accounts are a great way for beginners to familiarize themselves with the platform and learn how to trade.

-

What is CopyTrading on eToro?

- CopyTrading is a feature on eToro that allows users to automatically replicate the trades of selected traders in their own portfolios. Users can browse through the profiles of top-performing traders, analyze their trading strategies, and choose to copy their trades.

-

How can I fund my eToro account?

- You can fund your eToro account using various payment methods, including bank transfers, credit/debit cards, and online payment processors such as PayPal and Skrill.

-

What are the fees on eToro?

- eToro charges various fees, including spreads, overnight fees for leveraged positions held overnight, withdrawal fees, and inactivity fees for dormant accounts. Make sure to review eToro’s fee schedule before trading.

-

Is there a minimum deposit requirement for eToro accounts?

- Yes, eToro may have a minimum deposit requirement for account funding. The minimum deposit amount may vary depending on your country of residence and the payment method used.

These FAQs provide a basic overview of eToro accounts and services. Users should review eToro’s documentation and support resources for detailed information and assistance with specific account-related inquiries.

Pros and cons of buy verified e-toro account:

Here are the pros and cons of using an e-Toro account:

Pros:

- Social Trading: eToro pioneered social trading, allowing users to follow and copy the trades of successful investors. This feature is particularly beneficial for beginners who can learn from experienced traders.

- Diverse Asset Selection: e-Toro offers a wide range of financial instruments, including stocks, cryptocurrencies, commodities, forex, and indices, providing users with diverse investment opportunities.

- Regulation: e-Toro account is regulated by top-tier financial authorities in multiple jurisdictions, ensuring compliance with strict regulatory standards and providing users with a level of security and trust.

- User-Friendly Interface: eToro’s platform is designed to be intuitive and user-friendly, making it accessible to both novice and experienced traders. The platform offers easy-to-use tools for market analysis, portfolio management, and trading execution.

- CopyTrading: With eToro’s CopyTrading feature, users can automatically replicate the trades of selected traders in their own portfolios, allowing them to benefit from the expertise and strategies of successful investors.

- Demo Accounts: e-Toro account offers demo accounts that allow users to practice trading with virtual funds before risking real money. This feature is valuable for beginners to gain experience and confidence in trading.

- Mobile App: e-Toro account provides a mobile app for iOS and Android devices, allowing users to trade and manage their portfolios on the go. The mobile app offers full functionality and access to the same features as the web platform.

Cons:

- Limited Research Tools: eToro’s research tools may be limited compared to some other trading platforms. Advanced traders may find the technical analysis and research capabilities insufficient for their needs.

- High Spreads: e-Toro account charges spreads on trades, which can be higher compared to some other brokers. While spreads vary depending on the asset being traded, they can impact overall trading costs.

- Withdrawal Fees: e-Toro account may charge withdrawal fees for transferring funds out of the platform. These fees can add up, especially for frequent withdrawals or for users with smaller account balances.

- Limited Charting Features: While eToro’s platform offers basic charting tools, advanced traders may find the charting features lacking compared to dedicated charting platforms.

- Inactivity Fees: e-Toro account charges inactivity fees for dormant accounts that have been inactive for a certain period. Users should be aware of these fees and ensure they remain active to avoid them.

- No Direct Market Access: e-Toro account operates as a market maker, meaning users do not have direct access to the underlying market. This can result in potential conflicts of interest and may impact trade execution.

Overall, e-Toro account offers a user-friendly platform with innovative features like social trading and CopyTrading, making it an attractive option for traders and investors of all experience levels. However, users should consider the platform’s fees, limitations, and regulatory aspects before opening an account.

Security of verified e-toro account for sale:

The security of an eToro account is a top priority for the platform, and several measures are in place to help protect users’ accounts and assets. Here are some key security features of e-Toro accounts:

- Regulation: e-Toro account is regulated by top-tier financial authorities in multiple jurisdictions, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). Regulatory oversight ensures that e-Toro account adheres to strict security and compliance standards.

- Secure Login: e-Toro account employs secure login protocols, including HTTPS encryption, to protect user credentials and data transmission between users’ devices and the e-Toro account servers. This helps prevent unauthorized access to users’ accounts.

- Two-Factor Authentication (2FA): e-Toro account offers two-factor authentication as an additional layer of security for user accounts. Users can enable 2FA to add an extra verification step, typically using a code sent to their mobile device, when logging in to their accounts.

- Strong Password Requirements: e-Toro account encourages users to create strong and unique passwords for their accounts. Passwords should be complex and include a combination of letters, numbers, and special characters to enhance security.

- Secure Funds Management: e-Toro account utilizes segregated bank accounts to hold client funds separately from company funds. This segregation of funds helps protect users’ assets in the event of insolvency or financial difficulties.

- Fraud Detection and Monitoring: e-Toro account employs advanced fraud detection and monitoring systems to identify and prevent fraudulent activities on the platform. Suspicious account activities, login attempts, and transactions are closely monitored to safeguard users’ accounts and assets.

- Customer Support and Education: e-Toro account provides customer support services to assist users with account-related inquiries, security concerns, and technical issues. Additionally, eToro offers educational resources and guidance on security best practices to help users protect their accounts and mitigate security risks.

- Continuous Improvement: e-Toro account regularly evaluates and enhances its security measures to address emerging threats and vulnerabilities. The platform conducts security audits, implements software updates, and collaborates with cybersecurity experts to maintain a robust security infrastructure.

While eToro implements various security measures to protect users’ accounts and assets, users should also take proactive steps to safeguard their accounts, such as enabling two-factor authentication, using strong passwords, avoiding suspicious links or emails, and staying informed about security best practices.

By working together with eToro’s security protocols and practicing good security hygiene, users can help ensure the safety and integrity of their accounts on the platform.

verified e-toro account for sale Supported country:

e-Toro account supports users from many countries around the world, but the availability of services may vary depending on regulatory requirements and local laws. e-Toro account accepts users from numerous countries, including the United States, the United Kingdom, Australia, Canada, most European countries, and many others.

However, it’s important to note that e-Toro account may have restrictions or limitations on certain services and features based on the user’s country of residence. Additionally, regulatory changes and compliance requirements may impact eToro’s availability in specific jurisdictions over time.

Before opening an e-Toro account, users should review the platform’s terms of service and verify if their country of residence is supported for account registration and trading activities. Users may also need to comply with local regulations related to financial services and investment products when using e-Toro’s services.

For the most up-to-date information on supported countries and any restrictions or requirements for using e-Toro account in a particular jurisdiction, users can refer to eToro’s official website or contact their customer support team for assistance.

Why people looking for verified e-toro account for sale:

People may be interested in opening an e-Toro account for several reasons:

- Social Trading: e-Toro account pioneered the concept of social trading, allowing users to follow and copy the trades of successful investors. This feature is particularly attractive to beginners who can learn from experienced traders and potentially replicate their success.

- Diverse Asset Selection: e-Toro account offers a wide range of financial instruments, including stocks, cryptocurrencies, commodities, forex, and indices, providing users with diverse investment opportunities across different markets.

- Regulation and Trustworthiness: e-Toro account is regulated by top-tier financial authorities in multiple jurisdictions, providing users with a level of security and trust. Regulatory oversight ensures that e-Toro account adheres to strict compliance standards and operates with transparency.

- User-Friendly Interface: e-Toro’s platform is designed to be intuitive and user-friendly, making it accessible to both novice and experienced traders. The platform offers easy-to-use tools for market analysis, portfolio management, and trading execution.

- CopyTrading and CopyPortfolios: With e-Toro’s CopyTrading feature, users can automatically replicate the trades of selected traders in their own portfolios. Additionally, e-Toro account offers CopyPortfolios, which are diversified investment portfolios managed by eToro’s investment team.

- Demo Accounts: e-Toro account provides demo accounts that allow users to practice trading with virtual funds before risking real money. This feature is valuable for beginners to gain experience and confidence in trading.

- Mobile Accessibility: e-Toro account offers a mobile app for iOS and Android devices, allowing users to trade and manage their portfolios on the go. The mobile app offers full functionality and access to the same features as the web platform.

- Educational Resources: e-Toro account provides educational resources, including trading guides, webinars, and market analysis, to help users improve their trading skills and knowledge of the financial markets.

Overall, e-Toro offers a comprehensive trading platform with innovative features, regulatory compliance, and a user-friendly interface, making it an attractive option for traders and investors of all experience levels. Whether users are interested in social trading, diversified investments, or access to various financial markets, e-Toro account provides tools and opportunities to meet their investment goals.

“Unlock Your Trading Potential with an e-Toro Account: Your Gateway to Diverse Investments”

Are you ready to take your trading journey to new heights? Look no further than e-Toro account – your premier destination for social trading, diverse investment opportunities, and a user-friendly trading platform. With an e-Toro account, you can access a world of financial markets and investment options like never before.

Here’s why opening an e-Toro account is the first step towards realizing your trading aspirations:

Social Trading Revolution: Join the social trading revolution with e-Toro’s account innovative platform. Connect with experienced traders, follow their strategies, and even automatically replicate their trades with the click of a button. Tap into the wisdom of the crowd and learn from the best in the business.

Diverse Asset Selection: With e-Toro account, you gain access to a diverse range of financial instruments, including stocks, cryptocurrencies, commodities, forex, and indices. Whether you’re interested in tech giants, digital currencies, or precious metals, e-Toro account offers something for every investor.

Regulated and Trusted: Rest assured knowing that e-Toro account is regulated by top-tier financial authorities in multiple jurisdictions. Our commitment to regulatory compliance ensures that your funds are safe and your trading experience is transparent and secure.

User-Friendly Interface: Say goodbye to complicated trading platforms. e-Toro’s account intuitive interface makes trading accessible to traders of all experience levels. Analyze markets, execute trades, and manage your portfolio with ease – anytime, anywhere.

CopyTrading and CopyPortfolios: Harness the power of CopyTrading to replicate the success of top traders in real-time. Or explore e-Toro’s diversified CopyPortfolios, managed by our expert investment team, for a hassle-free investment experience.

Practice with Demo Accounts: Not sure where to start? Practice trading with virtual funds using e-Toro’s demo accounts. Gain valuable experience and confidence before transitioning to live trading.

Mobile Accessibility: Trade on the go with e-Toro’s mobile app, available for iOS and Android devices. Stay connected to the markets and manage your portfolio seamlessly – even when you’re away from your desk.

Educational Resources: Expand your trading knowledge with e-Toro’s comprehensive educational resources. From trading guides to market analysis, we provide the tools and insights you need to succeed in the financial markets.

Ready to embark on your trading journey? Open an e-Toro account today and experience the future of trading. Whether you’re a seasoned investor or a newcomer to the world of trading, e-Toro account empowers you to trade smarter, invest confidently, and achieve your financial goals.

Join the millions of traders worldwide who have chosen e-Toro account as their preferred trading platform. Your trading adventure starts here. Sign up for your e-Toro account now!

Summary of buy e-toro Account:

An e-Toro account provides users with access to a comprehensive trading platform that offers social trading, diverse investment opportunities, and a user-friendly interface. Here’s a summary of key features and benefits of an e-Toro account:

- Social Trading: e-Toro pioneered social trading, allowing users to follow and copy the trades of successful investors. This feature enables users to learn from experienced traders and potentially replicate their success.

- Diverse Asset Selection: e-Toro offers a wide range of financial instruments, including stocks, cryptocurrencies, commodities, forex, and indices, providing users with diverse investment opportunities across different markets.

- Regulation and Trust: e-Toro account is regulated by top-tier financial authorities in multiple jurisdictions, ensuring compliance with strict regulatory standards and providing users with a level of security and trust.

- User-Friendly Interface: e-Toro’s account platform is designed to be intuitive and user-friendly, making it accessible to traders of all experience levels. The platform offers easy-to-use tools for market analysis, portfolio management, and trading execution.

- CopyTrading and CopyPortfolios: With e-Toro’s CopyTrading feature, users can automatically replicate the trades of selected traders in their own portfolios. Additionally, e-Toro account offers CopyPortfolios, which are diversified investment portfolios managed by e-Toro’s investment team.

- Demo Accounts: e-Toro provides demo accounts that allow users to practice trading with virtual funds before risking real money. This feature is valuable for beginners to gain experience and confidence in trading.

- Mobile Accessibility: e-Toro offers a mobile app for iOS and Android devices, allowing users to trade and manage their portfolios on the go. The mobile app offers full functionality and access to the same features as the web platform.

- Educational Resources: e-Toro provides educational resources, including trading guides, webinars, and market analysis, to help users improve their trading skills and knowledge of the financial markets.

In summary, an e-Toro account empowers users to trade smarter, invest confidently, and achieve their financial goals. With its innovative features, regulatory compliance, and user-friendly interface, e-Toro account is a preferred choice for traders and investors worldwide.

Brad –

Great job, that was faster than I thought. Highly recommended. Will hire definitely again.

Elmer –

Fantastic services! So fast delivery. Thank you so much

Jimmie –

Delivered as expected. very important service!

Gabriel –

They delivered instantly to my account so far. Thank you, accountunltd.com Team. I will order again’